Where do investors stand on cryptocurrencies? Faith outweighs fear, new survey finds

What's New | Nov 15, 2021 04:52

With cryptocurrencies routinely surpassing or approaching all-time-high values, an air of mystery and caution also continues to accompany digital currencies from an investment perspective due to the perception that they foment instability in the markets. Where exactly do investors stand on cryptocurrencies as the end of 2021 approaches?

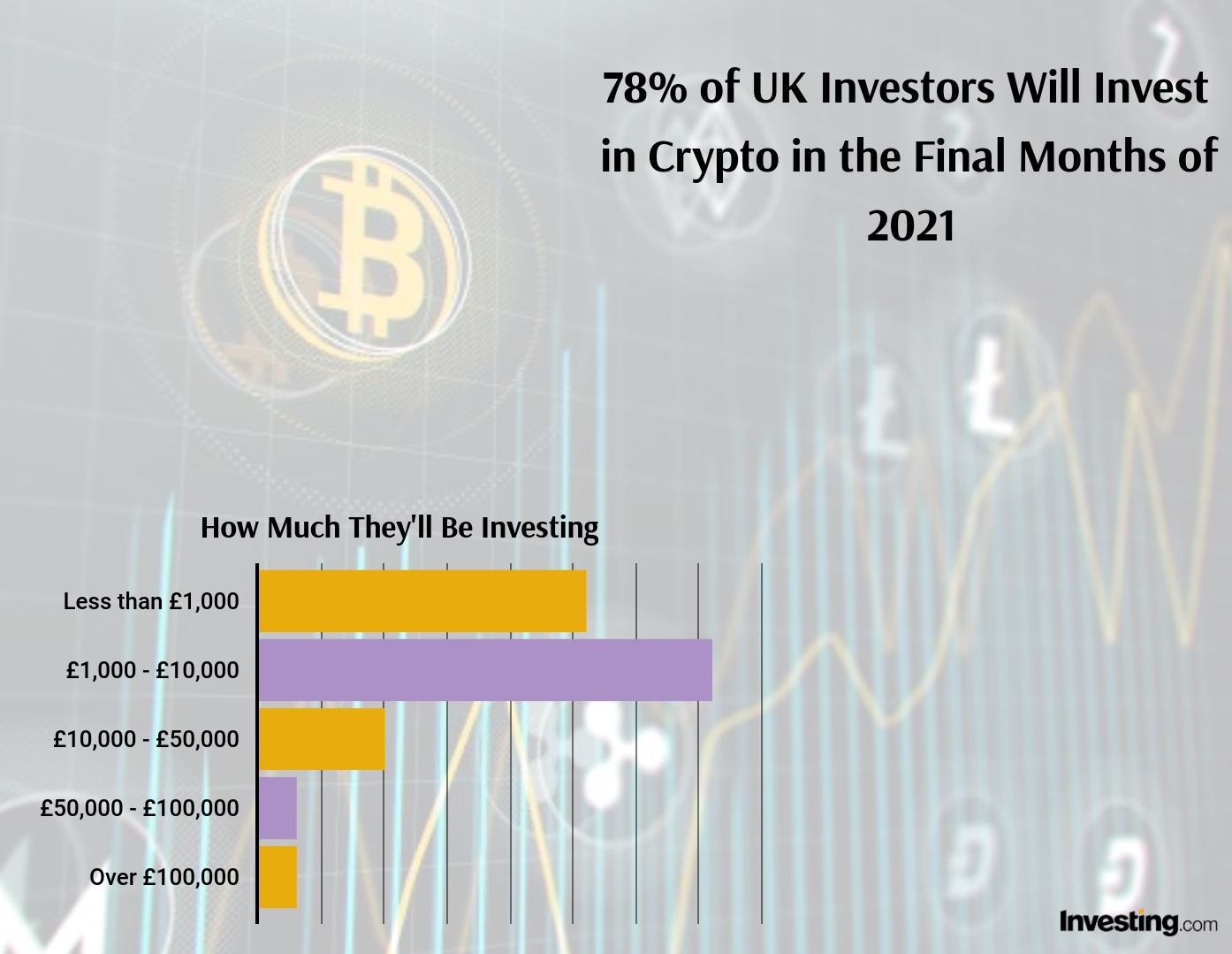

In a new survey of 1,118 respondents in the UK, uk.Investing.com found that faith outweighs fear, as 78 percent of investors plan on investing in cryptocurrencies over the next few months. Thirty eight percent intend to invest between £1,000 and £10,000 before the end of the year, and 26 percent plan to invest less than £1,000. The strong interest in digital currency comes despite the fact that 16 percent of investors admitting that they have no idea what the blockchain system is — a trend even greater among Gen Z’s, with 1 in 3 of these younger investors admitting to having no understanding of the technology.

“A new generation of investors, which entered the market after the rise of commission-free trading during the pandemic, is turning the crypto space on its head,” said Jesse Cohen, senior analyst at uk.Investing.com. “They're much more likely to invest in risky cryptocurrencies than the older generation and they're doing their own research on platforms like Twitter (NYSE:TWTR), Reddit and TikTok, instead of paying attention to the Wall Street experts.”

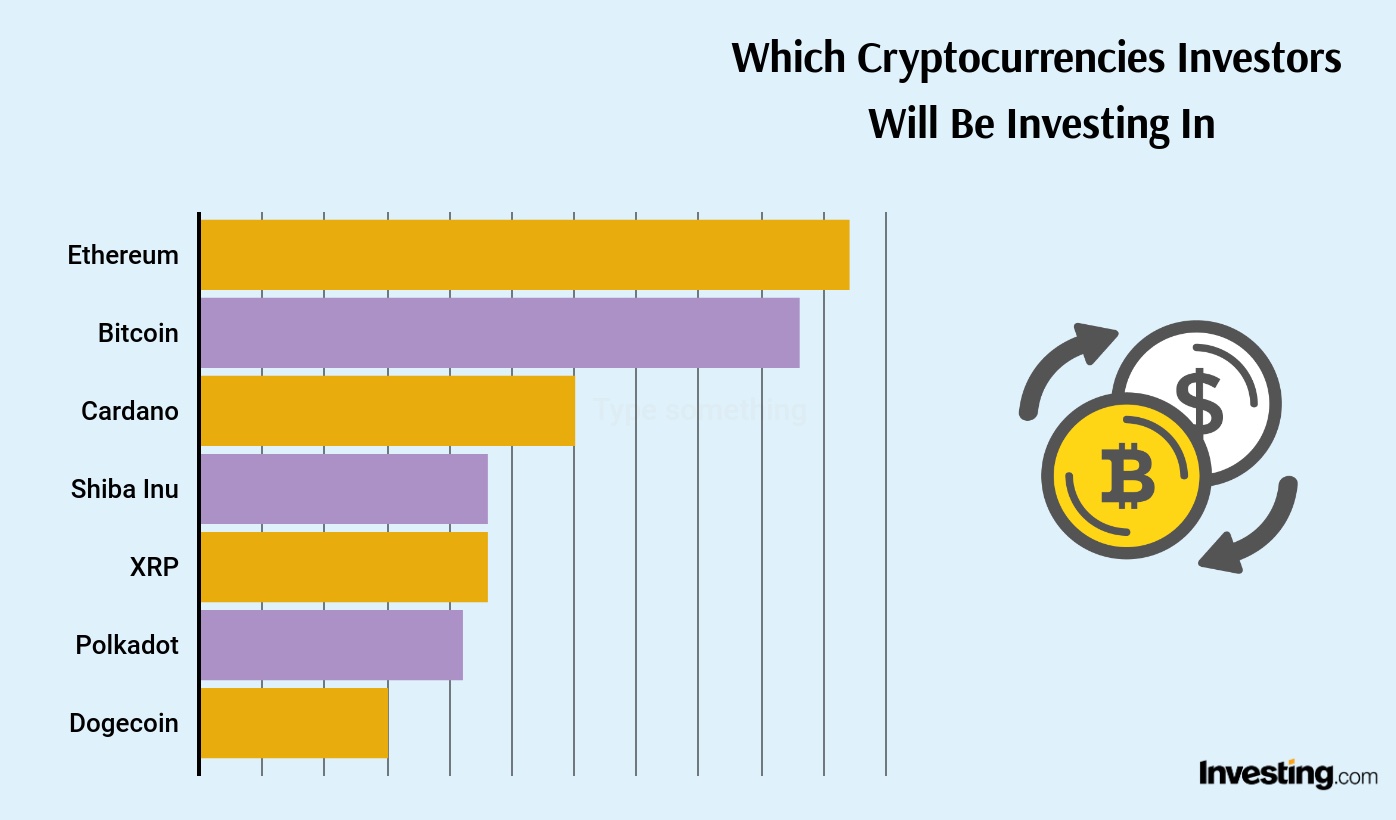

Fifty two percent of respondents plan to invest in Ethereum, notably exceeding the 48 percent who anticipate investing in the best-known cryptocurrency, Bitcoin. The value of both of those cryptocurrencies has been surging, jumping to new records. Twenty three percent plan to invest in the Shiba Inu coin, which following astronomical gains over a 15-month period recently plunged by 50 percent, likely indicating that those investors see a crucial buying opportunity in this moment.

“Many crypto investors have turned more bullish on Ethereum over the past year thanks to its increased involvement in DeFI projects and NFTs. With the price still below the $5,000-level, many expect ETH to double its price in 2022,” asserted Cohen."

Seventy four percent believe Bitcoin will hit a new record value exceeding $70,000 by the end of this year, while just 26 percent believe it has already reached its ceiling for 2021. Heading into next year, 37 percent see Bitcoin reaching $70,000 - $100,000 in 2022, with 44 percent predicting a value above $100,000 and 19 percent stating that the cryptocurrency will not reach the highs of 2021.

“Bitcoin is showing no signs of slowing down with mainstream adoption likely to gain further momentum in the year ahead,” Cohen added. “The flush of ultra-cheap money being pumped into the global financial system by the Federal Reserve and growing fears of inflation will continue to drive money into the crypto space in 2022.”

Thirty one percent of investors say they fully trust Bitcoin and other cryptocurrencies, while 21 percent do not trust them at all, and 6 percent believe they are a scam. New regulatory restrictions represent the biggest problem of cryptocurrencies, according to 44 percent of investors. A pullback leading to a big selloff (22 percent) and competition from central banks (15 percent) are the two next-largest concerns in the eyes of investors.

Fifty percent of investors check cryptocurrency prices several times per day, and 24 percent check once a day. In terms of the channels they trust the most when it comes to news on cryptocurrencies, 43 percent opt for independent analysts and 31 percent for experts in blockchain technology — amplifying the importance of uk.Investing.com’s cryptocurrency section, a one-stop shop that empowers retail investors with real-time and comprehensive news, information, and analysis on the world of digital currencies.

Be the first to comment on

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.