6 Dividend Champions for Safely Compounding This Year's Hefty Market Gains

Investing.com | Feb 28, 2024 11:05

- Dividend ETFs can be great options for those looking to invest for regular income.

- However, some investors prefer to invest in individual stocks.

- So in this article, we will take a look at some top stocks with upside potential along with the best ETFs.

- Investing in the stock market? Take advantage of our InvestingPro discounts . More information at the end of this article.

- Dividend yield: 4.99%

- Focuses on Japanese dividend-paying companies.

- Dividend yield: 3.81%

- Manages 4.9B in assets.

- Dividend yield: 6.23%

- Manages $8.4B in assets.

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add shortly.

Investors often find dividends attractive, but it's not wise to base stock purchases solely on high dividend yields. While dividends can be a bonus, they shouldn't be the primary reason for buying stocks.

Before buying stocks for dividend yields, investors should consider aspects like financial health along with the stock's upside potential.

For those who aren't comfortable with investing in individual stocks, ETFs can be great options.

There are several well-known dividend ETFs to choose from. However, it's essential to examine their performance over the past few years before you decide to invest.

Here are the top dividend ETFs you can consider:

Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:VEA)

Schwab U.S. Dividend Equity ETF (NYSE:SCHD)

WisdomTree Japan Hedged Equity Fund (NYSE:DXJ)

While ETFs can be a great choice for some investors, others prefer to invest in individual stocks.

Below, we will take a look at some stocks with appealing dividend yields and bullish potential using the InvestingPro tool, which provides essential data for our analysis.

1. Uniti Group

Uniti Group (NASDAQ:UNIT) is engaged in the acquisition and construction of communications infrastructure and is a leading provider of fiber and other wireless solutions.

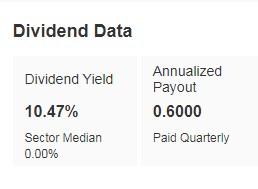

Its dividend yield is +10.47%.

Source: InvestingPro

On February 29 it presents its accounts. For 2024 the forecast is for an increase in earnings per share (EPS) of +82.4% and revenue of +3%.

Source: InvestingPro

Its scalable nationwide network has facilitated customized agreements with wireless service providers. The company expects growth in fiber projects and new network construction.

It has 10 ratings, of which 3 are buy, 7 are hold and 1 is sell.

The market sees a 12-month potential at $6.90.

Source: InvestingPro

2. Civitas Resources

Civitas Resources (NYSE:CIVI) is a company that focuses on the acquisition, development, and production of oil and natural gas in the Rocky Mountain region.

It was formerly known as Bonanza Creek (NYSE:BCEI) Energy. It was founded in 1999 and is headquartered in Denver, Colorado.

Its dividend yield is +12.07%.

Source: InvestingPro

On February 27th we will know its accounts. For 2024 the forecast is for an increase in earnings per share (EPS) of +29.7% and revenue of +57.9%.

Source: InvestingPro

Looking at various metrics, we see that the stock is undervalued.

The market sees 12-month potential at $88.91.

Source: InvestingPro

3. Organon

Organon & Co (NYSE:OGN) sells its products to hospitals, pharmacies, clinics, government agencies and other institutions. The company was incorporated in 2020 and is headquartered in Jersey City, New Jersey.

Its dividend yield is +6.95%.

Source: InvestingPro

It will report its results on May 2. For 2024 the forecast is for an increase in earnings per share (EPS) of +3.3% and revenues of +2.2%. Its last known results 12 days ago were good.

Source: InvestingPro

It has 10 ratings, of which 5 are buy, 3 are hold and 2 are sell.

Market expectations put the stock at $21.38.

Source: InvestingPro

4. AT&T

AT&T Inc (NYSE:T) was formerly known as SBC Communications and changed its name to AT&T in 2005. It was established in 1983 and is headquartered in Dallas, Texas.

It has a dividend yield of +6.61%.

Source: InvestingPro

April 24 will be the time to look at its accounts. Revenues rose +1.8% in the last report and heading into 2024 another +1.1% increase is also expected.

Source: InvestingPro

Both InvestingPro's models and the market agree on the 12-month potential of its shares, specifically at $19.19 and $19.84 respectively.

Source: InvestingPro

5. Guess

Guess (NYSE:GES) is an apparel company that also sells watches and jewelry. It was founded in 1981 and is headquartered in Los Angeles, California.

Its dividend yield is +4.82%.

Source: InvestingPro

It will report its numbers on March 20. Revenue is expected to increase by +8.39% and earnings per share by +9.90%.

Source: InvestingPro

Guess and WHP Global have announced a definitive agreement whereby Guess acquires the rag & bone fashion brand, which has become a prominent name in the US fashion industry, with 34 stores in the US and 2 in the UK.

It has 5 ratings, of which 3 are buy, 2 are hold and none are sell.

The market gives it a potential at $27.31, while InvestingPro models it at $31.39.

Source: InvestingPro

6. Clearway Energy (NYSE:CWENa)

Clearway Energy (NYSE:CWEN) operates in the renewable energy business in the United States. It was formerly known as NRG (NYSE:NRG) Yield and changed its name to Clearway Energy in August 2018.

It was founded in 2012 and is headquartered in Princeton, New Jersey.

The dividend yield is +7.27%. It will deliver $0.40 per share to shareholders on March 15, and to receive it, shares must be held by February 29.

Source: InvestingPro

May 2 is the time to publish its accounts. For 2024 it expects an increase in revenue of +9.7%.

Source: InvestingPro

The potential the market sees for it in 12 months would be around $29.

Source: InvestingPro

***

Do you invest in the stock market? Set up your most profitable portfolio . With it, you will get:

Act fast and join the investment revolution - get your OFFER

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.