3 Undervalued Stocks to Buy as Investors Rotate Out of Tech

Investing.com | Jun 26, 2024 09:45

- As investors rotate out of the tech sector, there are plenty of compelling opportunities in other corners of the market.

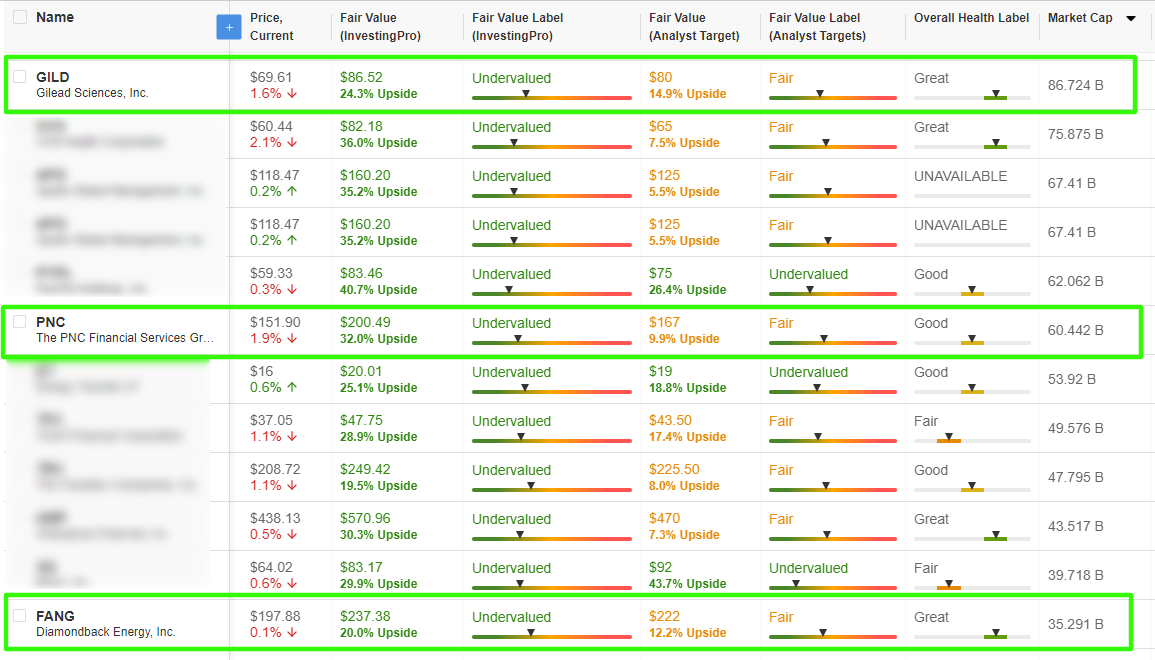

- I used the InvestingPro Stock Screener and Fair Value feature to find cheap, undervalued companies with significant upside potential.

- With a wide array of features, InvestingPro empowers investors to identify undervalued stocks and capitalize on market trends.

- Looking for more actionable trade ideas? The InvestingPro Summer Sale is live: Subscribe for under $7/month !

- ‘Fair Value’ Upside: +24.3%

- Market Cap: $86.7 Billion

- HIV Treatment Market Leadership: Gilead continues to dominate the HIV treatment market with its leading therapies, providing a stable revenue base and opportunities for growth through new drug approvals and advancements.

- Oncology Expansion: The biotech company is expanding its oncology portfolio through strategic acquisitions and partnerships, aiming to capture a larger share of the cancer treatment market. This includes its acquisition of Immunomedics (NASDAQ:IMMU), which brings the promising cancer drug Trodelvy into Gilead's portfolio.

- Strong Product Pipeline: Gilead has a robust pipeline of new drugs and therapies in various stages of development. This pipeline includes new treatments for HIV, oncology, and liver diseases, which are expected to drive future revenue growth.

- ‘Fair Value’ Upside: +32%

- Market Cap: $60.5 Billion

- Digital Transformation: PNC has been investing heavily in its digital banking platform, enhancing customer experience through innovative technologies such as mobile banking, online banking, and digital payment solutions. These advancements are expected to attract a tech-savvy clientele, driving growth in its digital banking segment.

- Wealth Management Expansion: PNC is focusing on expanding its wealth management and advisory services, targeting high-net-worth individuals and institutional clients. By offering personalized financial planning, investment management, and trust services, PNC aims to capture a larger share of the growing wealth management market.

- Expansion Initiatives: PNC's strategic acquisitions, such as the acquisition of BBVA (BME:BBVA) USA, have significantly strengthened its presence in key regions. This acquisition is expected to drive revenue growth and enhance PNC's competitive position.

- ‘Fair Value’ Upside: +20%

- Market Cap: $35.3 Billion

- Elevated Oil Prices: With global energy demand rebounding and oil prices recovering, Diamondback Energy is well-positioned to benefit from higher commodity prices. This recovery supports improved revenue and profitability.

- Operational Efficiency: Diamondback is recognized for its low-cost operations and strong cash flow generation. The company's focus on operational efficiency and cost control ensures resilience even in volatile market conditions.

- Strategic Acquisitions: Diamondback's strategic acquisition of high-quality assets in the Permian Basin further enhances its production capabilities and reserve base. It agreed to buy fellow Permian Basin driller Endeavor Energy Resources in a $26 billion deal earlier this year, solidifying its position as a top-tier operator in the region.

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

As investors begin to rotate out of the high-flying tech sector, several promising opportunities in other areas of the market offer substantial upside potential.

Using the power of the InvestingPro stock screener, I identified three such stocks to consider: Gilead Sciences (NASDAQ:GILD), PNC Financial Services (NYSE:PNC), and Diamondback Energy (NASDAQ:FANG).

Each of these companies has strong tailwinds working in their favor, making them attractive investment options in the current market environment.

Moreover, according to InvestingPro Fair Value models, all three stocks are trading at significant discounts, providing substantial upside potential.

You, too, can leverage InvestingPro's advanced research and analysis tools to uncover actionable investment opportunities and make informed decisions.

Subscribe today to take advantage of this offer !

1. Gilead Sciences

Gilead Sciences is a leading biopharmaceutical company that focuses on the research, development, and commercialization of innovative medicines. Gilead’s extensive portfolio includes treatments for HIV, hepatitis B and C, influenza, cancer, and inflammatory diseases.

The Foster City, California-based company has made significant contributions to antiviral therapies, solidifying its position as a prominent player in the biopharmaceutical industry.

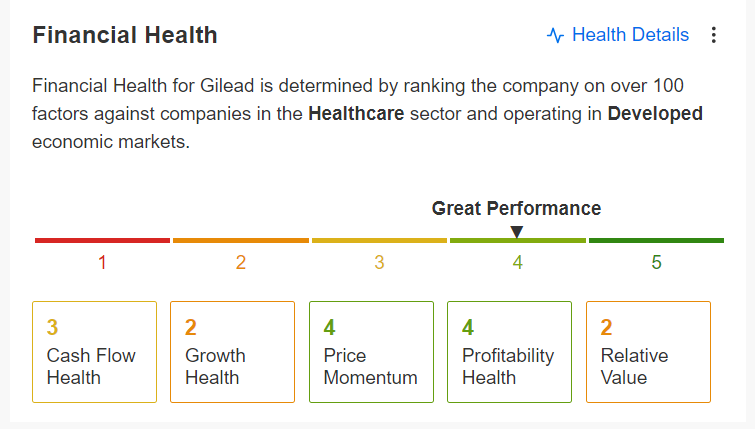

Source: InvestingPro

As InvestingPro points out, Gilead Sciences has an above-average ‘Financial Health Score’, highlighting its robust profitability outlook and free cash flow yield. Additionally, it should be noted that the company has raised its annual dividend payout for nine years in a row.

Tailwinds and Growth Prospects:

Valuation:

Gilead Sciences is trading at an attractive valuation with InvestingPro's AI-powered Fair Value model indicating a +24.3% upside potential from last night’s closing price of $69.61. That would bring shares closer to their Fair Value price target of $86.52.

Source: InvestingPro

This substantial upside, combined with the company's strong pipeline and market leadership, makes Gilead a compelling buy amid the current market backdrop.

2. PNC Financial Services

PNC Financial Services Group is a diversified financial services company offering a wide range of banking products and services, including retail banking, corporate and institutional banking, and asset management. Operating primarily in the United States, PNC is known for its strong regional presence and exceptional customer service. The bank serves millions of clients, including individuals, small businesses, corporations, and government entities.

The Pittsburgh, Pennsylvania-based company is one of the largest Small Business Administration lenders and one of the largest credit card issuers in the nation.

Source: InvestingPro

As seen above, InvestingPro paints a mostly bullish picture of PNC’s financial health, highlighting its attractive valuation, encouraging fundamentals, and dependably profitable business model. Additionally, it should be noted that the lender has maintained its dividend payout for 54 consecutive years.

Tailwinds and Growth Prospects:

Valuation:

PNC Financial Services is currently significantly undervalued, with InvestingPro's AI-powered Fair Value model indicating a massive +32% upside potential from its current market value of $151.90. Such a move would take shares within proximity of their Fair Value price target of $200.49.

Source: InvestingPro

This significant upside, along with its strong digital transformation efforts and strategic growth initiatives, positions PNC as an attractive investment.

3. Diamondback Energy

Diamondback Energy is an independent oil and natural gas company that focuses on the acquisition, development, exploration, and exploitation of onshore oil and natural gas reserves in the Permian Basin in West Texas. The region, which spans across western Texas and southeast New Mexico, accounts for approximately 30% of total domestic oil output, making Diamondback a major player in the U.S. energy sector.

Renowned for its efficient operations and high-quality asset base, the Midland, Texas-based company has established itself as a leader in the energy industry, particularly in one of the most prolific oil-producing regions in the United States.

Source: InvestingPro

It is worth mentioning that Diamondback Energy has a near-perfect company Financial Health score, with InvestingPro highlighting its upbeat earnings prospects, rising net income, and overall strong profitability outlook.

Tailwinds and Growth Prospects:

Valuation:

Diamondback Energy is trading at a discount, with InvestingPro's AI-powered Fair Value model indicating an upside potential of +20% from Tuesday’s closing price of $197.88. That would bring PNC stock closer to its Fair Value price of $237.38.

Source: InvestingPro

This substantial upside, coupled with the company's strong operational performance and favorable industry dynamics, makes Diamondback Energy a solid investment amid the current market backdrop.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Our InvestingPro Summer Sale Is Now Live !

Readers of this article can subscribe to InvestingPro for less than $7 a month as part of our summer sale.

To apply the discount, don't forget to use the coupon codes PROTIPS20242 (bi-yearly).

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.