By Stephen Nellis and Ayanti Bera

(Reuters) - The incoming chief executive of Intel Corp (NASDAQ:INTC) said on Thursday that most of the company's 2023 products will be made in Intel factories but he sketched a dual-track future in which it will lean more heavily on outside factories.

The lack of a strong embrace of outsourcing from new CEO Pat Gelsinger drove shares down 4.7% after hours. Shares rose 6.5% during regular trade, when the results were released ahead of the close. The company said it was investigating "non-authorized" access to some of the results, with the Financial Times quoting its chief financial officer as saying the microchip maker had been hacked.

Intel also forecast first-quarter revenue and profit above Wall Street expectations, continuing to benefit from pandemic demand for laptops and PCs that have powered the shift to working and playing from home.

Gelsinger said he was "confident that the majority of our 2023 products will be manufactured internally" though he also said the use of outside chip factories is likely to increase "for certain technologies and products."

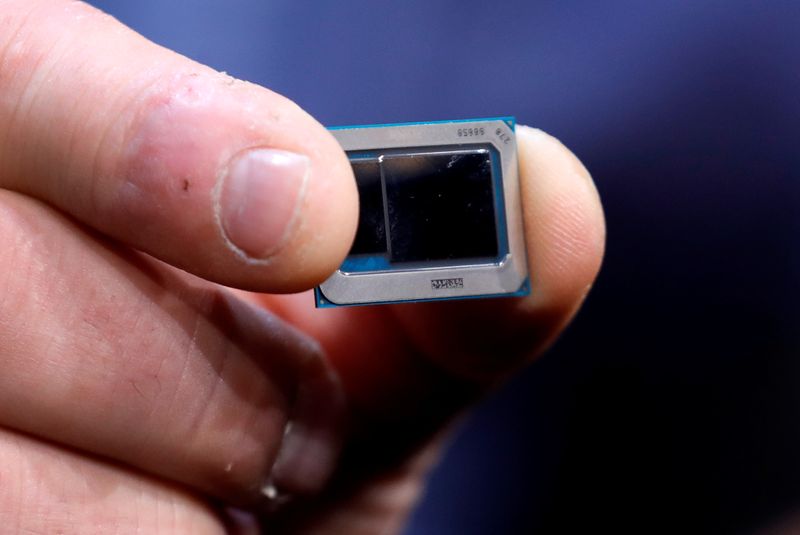

Intel has been considering since last July whether to drop its decades-old strategy of both designing and making chips by turning for help on its central processing units, or CPUS, to "foundry" manufacturers. Those partners could be Taiwan Semiconductor Manufacturing Co and Samsung Electronics (LON:0593xq). Intel's manufacturing technology, called a 7-nanometer process, is expected in 2023.

"We didn’t get our answer on which foundries and when," said Patrick Moorhead of Moor Insights & Strategy. "They pushed the can down the road."

Kinngai Chan, analyst at Summit Insights Group, said Intel is not likely to outsource its flagship chips.

"Intel's 14-nanometer chip transistor speed has always been faster than what any foundry can offer even at 7-nanometer," Chan said. "We believe it will increase its use of external foundries over-time - just not for its large-core CPUs."

Keeping manufacturing in-house means higher investments. Bernstein analyst Stacy Rasgon questioned whether Gelsinger, currently the chief executive of VMware Inc who previously spent 30 years at Intel and announced his intention to return just last week, has had sufficient time to dig into the issue.

"It was pretty obvious they were trying to borrow his credibility" when Gelsinger endorsed Intel's delayed 7-nanometer technology, Rasgon said.

Intel's decision coincides with U.S. lawmakers having passed bipartisan legislation to fund U.S. chip manufacturing. But the new law has yet to specify funding levels or recipients, and Forrester Research analyst Glenn O'Donnell said Intel might take the opportunity to solicit U.S. government support for domestic manufacturing.

Boosted by a new high-end PC processor, Intel regained some momentum in the PC market, with volumes of PC chips rising 33%, faster than the 26% rise for the overall PC market, according to data from IDC.

Data center group sales, which powered Intel's growth over the past several years, were $6.1 billion compared with analyst estimates of $5.48 billion, according to FactSet data.

But sales to cloud computing customers, some of the largest and fastest-growing purchasers of data center chips, were down 15% in the fourth quarter. Data center chip operating margins were 34% in the quarter, down from 48% a year earlier.

"We think (data center) operating margins are going to improve as we get toward the second half of the year, when we expect to see a rebound in cloud" chip sales, Intel Chief Financial Officer George Davis said.

The company also raised its dividend by 5%.

The chipmaker said it expects fiscal first-quarter adjusted sales of $17.5 billion and adjusted earnings per share of $1.10, both ahead of analyst consensus, according to IBES data from Refinitiv.

Fourth-quarter revenue of $20 billion and adjusted earnings per share of $1.52 also beat Wall Street targets.

(This story corrects spelling of nanometer in paragraph 10)