By John Miller

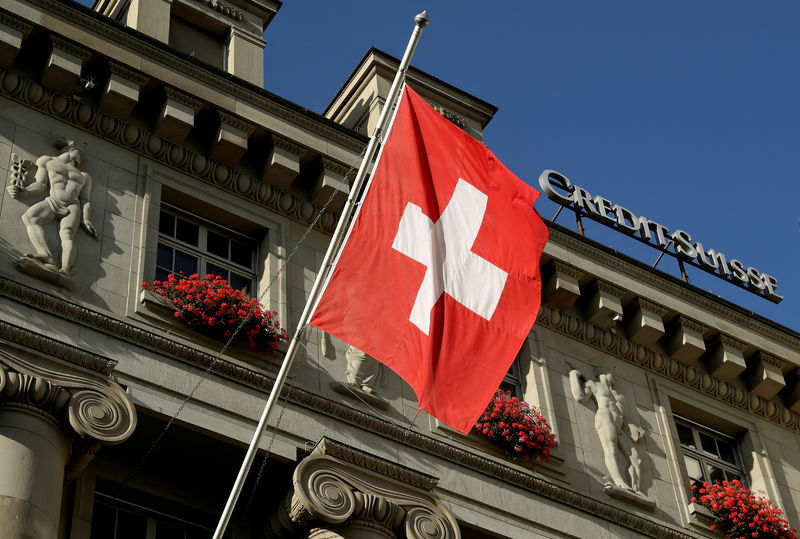

ZURICH (Reuters) - Credit Suisse (S:CSGN) failed to adequately combat money laundering in suspected corruption cases linked to soccer's ruling body FIFA and Venezuelan and Brazilian state oil companies, Switzerland's financial watchdog FINMA said on Monday, dealing a blow to the bank's reputation.

Watchdog FINMA will appoint an independent auditor to oversee the bank's anti-money laundering processes, but stopped short of forcing it to return any profits that it might have illegally reaped. FINMA has no authority to fine banks it supervises.

Switzerland's second-biggest bank behind UBS (S:UBSG) also fell short of its obligations to fight corruption while managing "a significant business relationship" with a politically exposed person, the authority said on Monday.

Credit Suisse said in a statement the Swiss watchdog had uncovered "legacy weaknesses", adding it has acted to bolster compliance since Chief Executive Tidjane Thiam took over from his predecessor, Brady Dougan, in March 2015.

Instead of disciplining a star private banker who breached compliance regulations for years, FINMA said Credit Suisse boosted his pay.

A banking source identified the manager as Patrice Lescaudron, jailed for five years in February.

"The identified shortcomings occurred repeatedly over a number of years, mainly before 2014," FINMA said, adding that many of the problems emerged from group subsidiary Clariden Leu AG, which was fully merged into Credit Suisse in 2012.

"FINMA identified deficiencies in the anti-money laundering process, as well as shortcomings in the bank's control mechanisms and risk management," the authority added.

The independent auditor will monitor Credit Suisse to ensure it follows through on improvements.

The enforcement action against Credit Suisse emerged from FINMA's investigation into several Swiss financial institutions starting in 2015 in relation to suspected corruption involving FIFA, Brazil's Petrobras (SA:PETR4) and the Venezuelan state oil company PDVSA.

The shares fell 0.1 percent at 0840 GMT, in line with the benchmark Swiss Market Index (SSMI).

PAST FAILINGS

Thiam has been forced to manage repeated allegations of wrongdoing that Credit Suisse said preceded his arrival, including charges of foreign exchange rates rigging in Europe, a hiring corruption probe in Asia and a $1 billion graft probe involving Venezuela's state oil company.

FINMA last year reprimanded Credit Suisse over its dealings with Malaysian state fund 1MDB. Singapore's central bank also fined the bank for breaching money laundering rules in the case.

Analysts said the regulator's harsh tone and the instalment of a monitor could dent confidence in Credit Suisse's efforts to fix problems of the past.

"FINMA's statements will hardly calm things down, since it put it out there in black and white what it thinks about the quality of the bank's efforts to fight money laundering," Zuercher Kantonalbank analyst Javier Lodeiro said.

"Still, this enforcement action did focus on the time between 2006 and 2015."

FINMA acknowledged Credit Suisse has undertaken measures since 2015 to strengthen compliance and anti-money laundering protections, but said more must be done "to prove that higher-risk business relationships and transactions are adequately detected, categorised, monitored and documented".

Lescaudron, the Geneva-based relationship manager, was found guilty of serious fraud and forgery in his handling of clients, including former Georgian Prime Minister Bidzina Ivanishvili and Russian oligarch Vitaly Malkin, over an eight-year period.

That case reveals weaknesses in the bank’s organisation and risk management, FINMA said. "Instead of disciplining the client manager promptly and proportionately, the bank rewarded him with high payments and positive employee assessments."

Credit Suisse said it has not been fined, ordered to hand over profits or had any curbs on its business activities, suggesting its failings were less serious than those committed by some other Swiss financial institutions.

Earlier this year, FINMA ordered PKB Privatbank SA Lugano to surrender 1.3 million Swiss francs (£1.03 million) in unlawfully generated profits after concluding it committed serious breaches linked to its business with Petrobras.

Credit Suisse said that it has already made thousands of improvements to correct weaknesses as part of a restructuring programme that Thiam began, including hiring 800 compliance specialists in the last three years.