By Paulina Duran

SYDNEY (Reuters) - Australia's largest pension fund, AustralianSuper, said it will vote against the executive pay of three of the country's biggest banks, in a show of the investment community's souring attitude towards the sector following a year-long misconduct probe.

Westpac Banking Corp (AX:WBC), the country's second-largest lender, would be first to receive AustralianSuper's protest vote at its annual shareholder meeting on Wednesday.

The pension fund said it would also vote against the executive pay plans of Australia and New Zealand Banking Group Ltd (AX:ANZ) and National Australia Bank Ltd (AX:NAB) in the coming weeks.

"AustralianSuper is disappointed at the approach taken by the boards at ANZ, NAB and Westpac over executive remuneration and will be voting against them at the upcoming AGMs," Ian Silk, AustralianSuper chief executive officer, said in a statement.

"In what has been an annus horribilis for the banking sector, there has been a distinct lack of transparency from the banks around their rationale for paying executive bonuses this year."

Under Australian corporate rules, if more than a quarter of shareholders vote against a pay proposal for two years running, they can call for the board to be removed.

With about A$8 billion (4.56 billion pounds) of retirement savings invested in the shares of large banks, AustralianSuper holds 2 percent to 2.5 percent of each of the four major lenders.

A powerful Royal Commission inquiry this year exposed major misconduct in Australia's financial industry, including allegations of rip-offs, mistreatment of customers, deception of regulators and even taking money from the dead.

The Australian Council of Superannuation Investors (ACSI), which advises pension funds on how to vote at shareholder meetings, is also urging others to vote against bank executive pay.

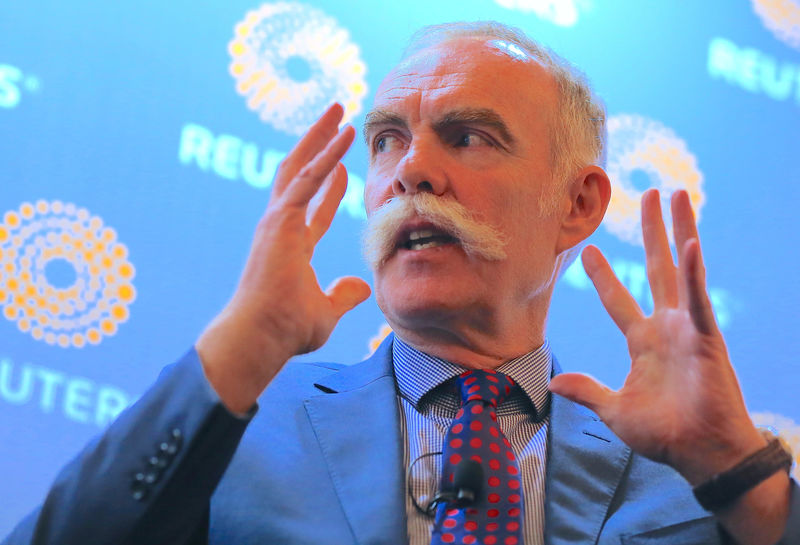

"The question we are asking is, what do they have to do not to get a bonus?" Louise Davidson, ACSI chief executive told Reuters.

Australian banks have said they would cut bonuses by 20 percent to 40 percent in response to the inquiry's findings, however Davidson said this was not enough.

Representatives of Westpac and NAB were not immediately available for comment. ANZ declined to comment.

No. 1 lender Commonwealth Bank of Australia (AX:CBA) held its annual general meeting in September, before AustralianSuper announced its protest vote. At CBA's AGM, just 5.8 percent of investors voted against its remuneration plans.