By Andrew Galbraith and Noah Sin

SHANGHAI/HONG KONG (Reuters) - Asian shares climbed on Monday, with markets in Europe poised to track their gains, after strong U.S. first-quarter economic growth and data showing profits at Chinese industrial firms grew for the first time in four months.

Still nagged by uncertainty over the outlook for the global economy, investors were awaiting a meeting of the U.S. Federal Reserve this week and Chinese factory data for further clues on policy direction in the world's biggest economies.

In early European trade for index futures, London's FTSE was 0.2 percent higher while Germany's DAX edged up 0.1 percent.

MSCI's broadest index of Asia-Pacific shares outside Japan gained 0.5 percent, rebounding from its biggest weekly drop in more than a month last week.

Chinese blue-chips jumped over 1 percent after losing 5.6 percent last week, leading Shanghai shares to an intraday high in afternoon trade.

Australian shares were down 0.4 percent after hitting an 11-year closing high on Friday, while Seoul's KOSPI was up 1.4 percent.

Japan's financial markets are closed for a long national holiday this week, but Nikkei 225 futures in Singapore was 0.9 percent higher.

Monday's gains follow data showing U.S. gross domestic product grew at a faster 3.2 percent annualised rate in the first quarter.

In China, fresh data showed industrial profits grew in March after four months of contraction, but analysts said sentiment remained fragile. Economists polled by Reuters expect factory activity in the world's second largest economy to grow at a steady but modest pace in April.

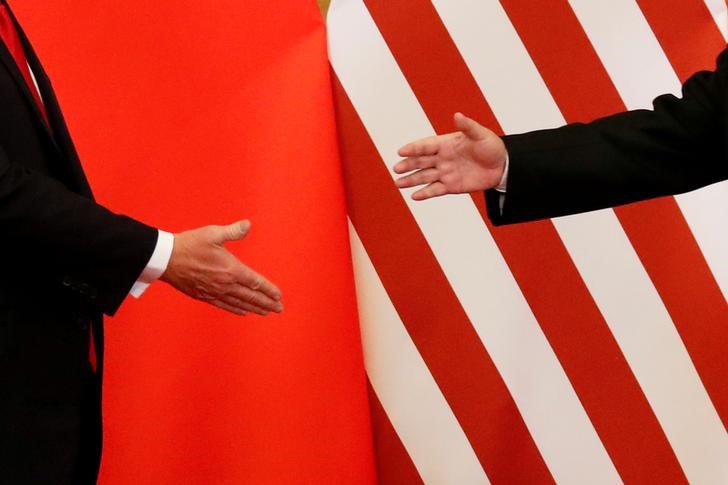

"Investors are still looking for direction in terms of growth, but at the same time there is still quite a lot of uncertainty" on U.S.-China trade and the U.S. dollar, said Joanne Goh, equity strategist at DBS Bank in Singapore.

"A strong U.S. dollar doesn't really bode well for Asian markets," she added.

In contrast with weakness in Asian markets last week, Wall Street ended Friday on a high note, propelled by the GDP figures.

The Dow Jones Industrial Average rose 0.31 percent to 26,543.33 and the Nasdaq Composite added or 0.34 percent to 8,146.40.

The S&P 500 gained 0.47 percent to 2,939.88, its second record closing high for the week.

Stephen Innes, managing partner at SPI Asset Management, said that despite stronger-than-expected earnings helping to lift markets, he saw investors' positioning on the S&P becoming "overly extended".

"We have flipped from a state where it is a stock rally no one wants to take part in, to a frenzied paced splurge where hedge funds and investors alike continue to chase markets like greyhounds to the mechanical rabbit," he said in a note.

While the strong U.S. GDP data helped to ease fears of an imminent recession, investors noted that it was driven by a smaller trade deficit and a large accumulation of unsold merchandise, as consumer and business spending slowed sharply.

The March reading for core personal consumption expenditures (PCE), the Fed's favoured inflation measure, is due later on Monday. The central bank's Federal Open Market Committee (FOMC) will announce its policy decision on Wednesday, with Chairman Jerome Powell expected to balance the strong domestic growth data against persistent concerns over the global outlook.

Markets will also be looking to global factory activity surveys this week, particularly official and private readings on Chinese manufacturing which will both be released Tuesday.

SEARCHING FOR STIMULUS

Chinese firms return to profit growth in March fuelled doubts over how much more stimulus Beijing can roll out without risking a rapid build-up in debt and potential asset bubbles.

"The hope that there will be more stimulus coming out from China probably is diminishing," said Goh at DBS.

"So if the FOMC confirms that the Fed continues to be quite dovish about the outlook for interest rates, I think investors will quite like that," she said.

With Japan on an extended break, currency markets were calm ahead of the FOMC meeting and U.S. jobs numbers. The dollar was pretty much flat against the yen at 111.61, and the euro was up 0.09 percent to $1.1158.

The dollar index, which tracks the greenback against a basket of six major currencies, turned 0.04 percent lower to 97.970.

U.S. crude dipped 0.65 percent at $62.89 a barrel, continuing lower after U.S. President Donald Trump on Friday pressured the Organization of the Petroleum Exporting Countries to raise crude production to ease gasoline prices.

Brent crude fell 0.61 percent to $71.71 per barrel.

Spot gold was down 0.1 percent, trading at $1,284.73 per ounce. [GOL/]

Graphic: Asian stock markets (https://tmsnrt.rs/2zpUAr4)

Graphic: US GDP PMI QoQ (https://tmsnrt.rs/2GPVctA)