By Jesse Cohen

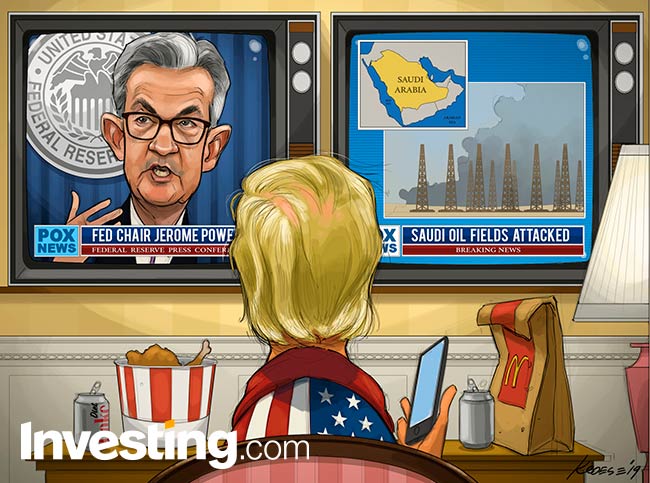

Investing.com - The Federal Reserve cut interest rates in a widely expected decision on Wednesday, but new policymaker projections showed no further reductions were anticipated in 2019, eliciting a fast and sharp rebuke from President Donald Trump.

Trump, who has repeatedly pressed the Fed to cut interest rates to “zero or less,” tweeted his displeasure shortly after the U.S. central bank lowered its benchmark overnight lending rate for the second time this year, taking it to a range of 1.75% to 2.00%.

Trump blasted Fed Chair Jerome Powell, saying the central bank chief had “no guts” and had failed again. "A terrible communicator," he added.

So-called dot-plot forecasts from all 17 policymakers showed seven expecting a third rate cut this year, five seeing the current rate cut as the last for 2019, and five who appeared to have been against even Wednesday's move.

Going forward "we are going to be highly data-dependent" in deciding on further rate moves, Powell said in a news conference following the Fed’s announcement.

The odds of an October cut have fallen to 45% from around 65% at the start of the month, according to Investing.com’s Fed Rate Monitor Tool.

Elsewhere, in commodities, oil markets have stabilized after attacks in Saudi Arabia over the weekend triggered a supply shock and sent prices soaring, but the volatility is still a risk as Middle East tensions remain high.

Trump tweeted on Wednesday that he has ordered Treasury Secretary Steven Mnuchin to “substantially increase” sanctions on Tehran, in the latest move of the to pressure the Islamic Republic.

Washington has blamed Iran for the attacks on Saudi oil fields, a charge which Tehran denies. U.S. Secretary of State Mike Pompeo has said the strike was "an act of war."

To see more of Investing.com’s weekly comics, visit: http://www.investing.com/analysis/comics

-- Reuters contributed to this report