By Adam Jourdan and Jorge Otaola

BUENOS AIRES (Reuters) - Argentine markets held steady on Wednesday, even as thousands of protesters took to the streets to demonstrate against the government of President Mauricio Macri and a darkening economic outlook in the recession-hit South American country.

The peso held its ground and bonds rose after newly imposed capital controls helped stabilize haywire markets that have plumbed record lows since Macri was trounced in a primary vote last month, dashing his hopes of re-election in October.

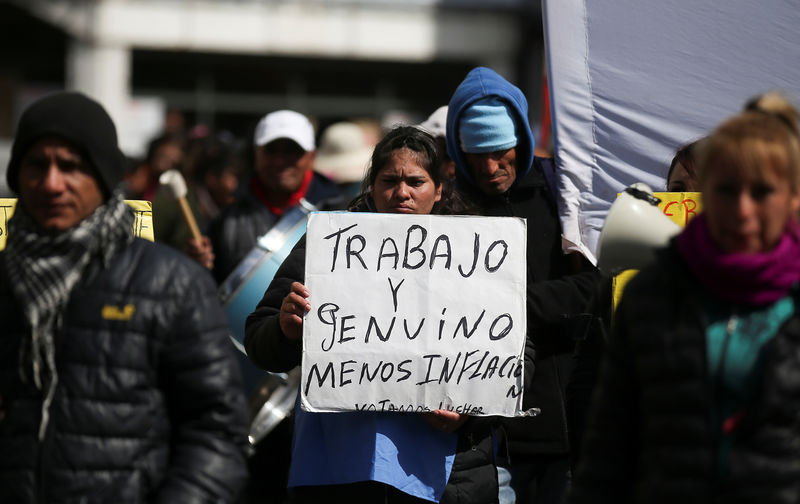

On the streets of Buenos Aires, protesters brandished banners slamming Macri's economic austerity policies, rising poverty, and the International Monetary Fund (IMF), which agreed to a $57 billion credit facility with the country last year.

"Salary increases now! The debt is with the people, not with the IMF," one banner with large red letters read. Others demanded proper wages and lower inflation, while some placards read "Macri and the IMF out."

Many Argentines have been bitterly resentful of the IMF since a massive economic crisis and devaluation in 2001 that they blame in part on the Fund's policies toward the country.

Argentine economic growth has stalled sharply since last year, while inflation is far outstripping salaries, leading to a sharp uptick in poverty, official data shows. That trend was one of the key reasons for Macri's larger-than-expected electoral defeat to left-leaning Peronist Alberto Fernandez.

"Given the fragility of our economy, we must now address the most urgent issues," Macri said at a business leaders event on Wednesday, adding that measures the government had taken were "only justified in an emergency".

"We must focus on trying to anticipate and contain as much as possible the potential negative impact that it's clearly having on the lives of all Argentines."

The government's focus was on stabilizing the exchange rate, protecting middle class savings and looking to build "consensus" with other political forces in the country, he added.

The peso closed flat at 56.02 per U.S. dollar with traders saying the central bank had sold dollars to bolster the currency. That came after the peso rose sharply on Tuesday as Wall Street cheered Macri's capital controls aimed at protecting the beleaguered markets.

The black market peso, traded in unofficial channels, also rose. Argentine over-the-counter bonds were up an average 4.7% on Wednesday, traders said, while the country's risk index fell. The Merval stock index (MERV) climbed more than 8%.

"(Argentina) took a very good step over the weekend when they announced the capital controls," said Carlos Abadi, managing director at financial advisory firm DecisionBoundaries in New York. He added, however, that the government also needed to address issues of tumbling bond prices that have raised the country's borrowing costs.

The primary election result sparked a market crash which saw the peso lose 26% of its value against the dollar in August. The country risk index soared and bond prices sank to record lows.

In response, Macri, who came to power in 2015 as a free-market champion and critic of interventionist policy, has rolled out plans to push back payments on around $100 billion of debt and imposed capital controls to protect the peso.

While markets have stabilized, the country's economic outlook has darkened. A central bank poll of economists hiked its inflation forecast for the year to 55% on Tuesday, and cut its outlook for the economy, which it now expected to shrink 2.5%.

Economists also sharply lowered the 2020 growth forecast from an expansion of 2% to a 1.1% contraction, suggesting a far deeper-than-expected recession ahead.