(Bloomberg) -- Oil held losses below $68 a barrel after French President Emmanuel Macron called for a new Iran nuclear deal to keep the U.S. on board, raising speculation sanctions on the OPEC producer may be averted.

Futures in New York were little changed after dropping 1.4 percent Tuesday. Macron proposed negotiating a new agreement that would curb Iran’s ballistic missile development and nuclear program ahead of next month’s decision by President Donald Trump on whether the U.S. will withdraw from the deal and reimpose sanctions on oil exports. Fears of an increase in U.S. crude inventories also weighed on prices.

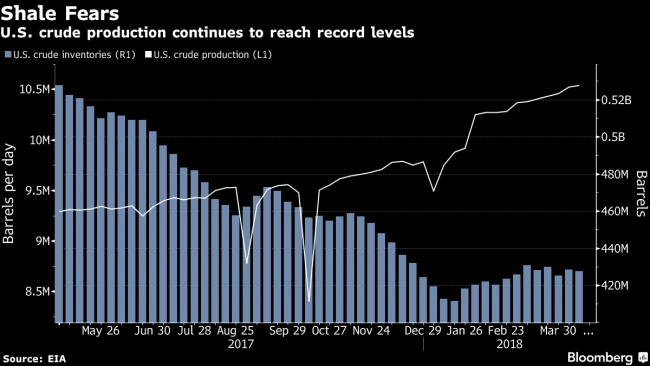

Oil has surged more than 7 percent this month on concern geopolitical risk in the energy-rich Middle East is intensifying, with Trump set to decide whether to extend Iran’s sanctions relief on May 12. While the Organization of Petroleum Exporting Countries and its allies concluded that they have all but wiped out a global crude surplus, fears remain that U.S. drillers may continue boosting output to record levels and offset the group’s effort to balance the market.

“Concerns that the U.S. may reimpose Iran sanctions and supplies from the country may be disrupted eased,” Takayuki Nogami, chief economist at state-backed Japan Oil, Gas & Metals National Corp., said by phone from Tokyo. Still, “uncertainty about Iran will likely remain until the final moment on May 12.”

West Texas Intermediate crude for June delivery traded at $67.69 a barrel on the New York Mercantile Exchange, down 1 cent, at 2:07 p.m. in Tokyo. Total volume traded was about 35 percent below the 100-day average.

Brent crude for June delivery was at $73.87 a barrel on the London-based ICE Futures Europe exchange, up 1 cent. Prices fell 85 cents to $73.86 a barrel on Tuesday. The global benchmark crude traded at a $6.17 premium to June WTI, near the widest level since January.

Futures for September delivery fell 1.9 percent to 438.9 yuan a barrel on the Shanghai International Energy Exchange. The contract climbed 1.7 percent to close at 447.3 yuan on Tuesday.

Macron remarks at a White House news conference with President Donald Trump came after Trump earlier warned Iran not to restart its nuclear program even if the U.S. withdraws from the 2015 nuclear accord with the Islamic Republic.

Iran’s oil exports would drop as much as 500,000 barrels a day this year and 700,000 barrels a day in 2019 if the U.S. reimposes sanctions, according to Fereidun Fesharaki, chairman of energy consultant FGE. When reimposed, U.S. sanctions will require buyers of Iranian crude to cut purchases within 180 days, according to Fesharaki.

Meanwhile, the American Petroleum Institute was said to report U.S. crude inventories increased by 1.1 million barrels last week. That comes against forecasts for a 2.2 million barrels decline, according to a Bloomberg survey ahead of government data due Wednesday.

In the U.S.’s Permian basin, output is forecast to reach 3.18 million barrels a day in May, the highest since the Energy Information Administration began compiling records in 2007. By contrast, top-producing members of OPEC such as Iran and Iraq pump less than 5 million barrels a day. Iran produced about 3.81 million barrels day in March, according to data compiled by Bloomberg.

Other oil-market news:

- The world’s biggest oilfield service companies have a message for investors: There’s a payoff for patience

- Crude in West Texas is the cheapest in three years versus Brent as an output surge in the past year outpaced pipeline construction and filled existing lines.