Market Overview

After the big dollar rally of the past week, there is a degree of unwind across major markets today. The developments in the trade dispute between the US and China continue to dominate the broad market sentiment. Whilst US President Trump pushed back on claims that both sides were ready to reduce tariffs proportionately, there is a sense that some sort of agreement is close.

There has been a significant steepening of the US yield curve in recent weeks and an accelerated move higher in longer dated yields has helped to strengthen the dollar. The move has also seen a realignment of flow out of bond markets and into equities to push Wall Street into all-time high territory. The move has also see assets such as gold also starting to show signs of direction after weeks of painstaking range play. A mild unwind in all of these moves is being seen early today but with little real driver, so is unlikely to be the start of a turnaround quite yet.

Wall Street closed higher into the end of the session on Friday with the S&P 500 +0.3% at 3093. US futures are corrective today though, down around -0.4%. Asian markets are lower with the Nikkei lower by -0.3%, whilst the Shanghai Composite -1.8% after Chinese PPI fell more than expected. European markets are following US futures lower with the FTSE futures and DAX futures both -0.4%. There is a USD slip across forex majors today with the only exception being a slight underperformance on AUD. In commodities, gold has rebounded slightly by around half a percent, whilst oil is a percent lower.

On the economic calendar the big focus is on UK growth. At 09:30 GMT the Prelim reading of UK Q3 GDP is expected to grow by +0.4% (form a final reading of -0.2% in Q2). UK Industrial Production for September with a loss of -0.2% in the month of September which would improve the year on year to -1.2% (from -1.8% YoY in August). Furthermore the UK Trade Balance is also at 09:30 GMT which is expected to marginally deteriorate to -10.0% in September (-£9.8bn in August).

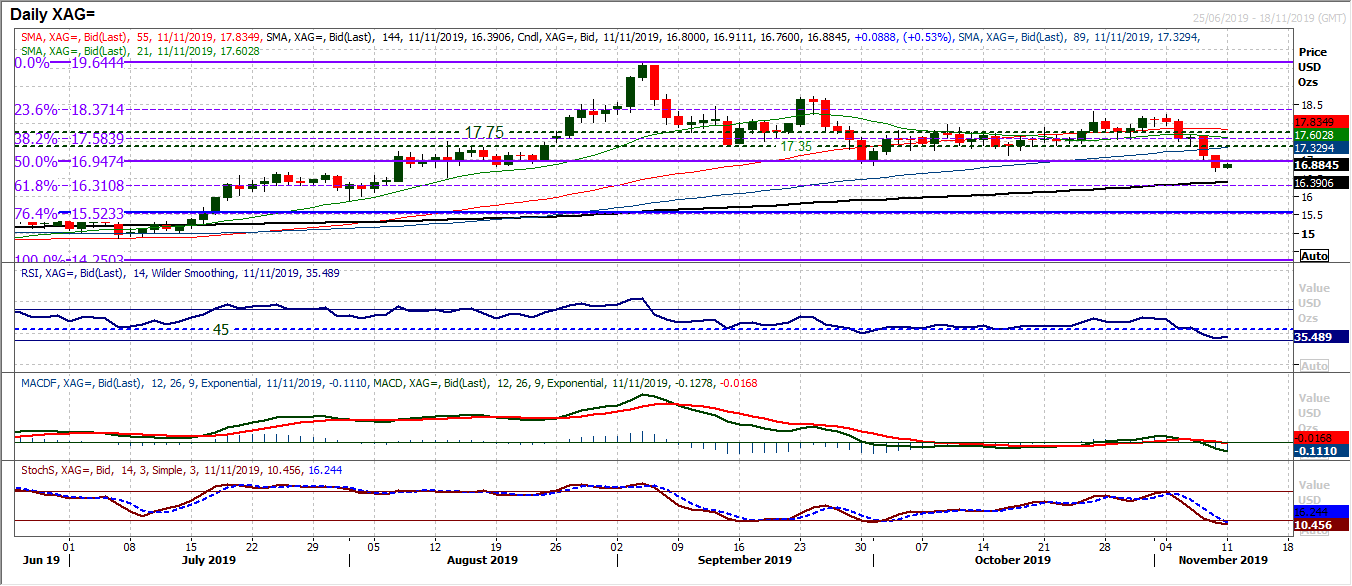

Chart of the Day – Silver

There has been a significant deterioration in the outlook for precious metals in recent days. This has resulted in a breakdown on silver. A closing break below the October low of $16.85 took silver to a two and a half month low and if confirmed today, marks a significant shift in outlook. The market has been relatively stable over recent months in a sideways range (between 40/60 on RSI), but Friday’s decisive move lower has come with RSI under 40 to a five month low, whilst MACD lines are getting traction now. If the move is confirmed by a second day closing breach of $16.85 then a much deeper correction could be developing. The breach of the 50% Fibonacci retracement at $16.95 means that this opens a downside test of the 61.8% Fib around $16.30 as the next move. The overhead supply of $16.85/$17.12 also becomes an area of resistance and potential sell zone now. Subsequently the early rebound this morning could be viewed as an opportunity if the rally starts to stall. Initial support around $16.55 under which is August higher low at $15.88.

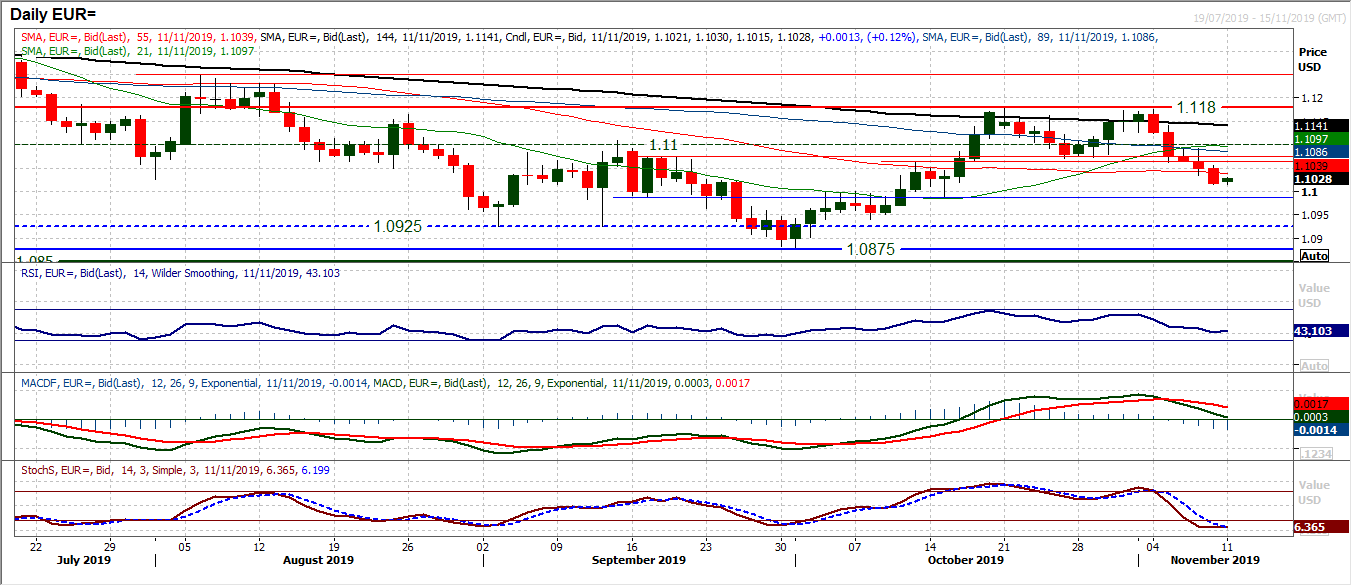

The euro has been under sustained corrective pressure now for a week. Five consecutive negative closes and bear candles has taken EUR/USD clear below the key support of the breakouts $1.1060/$1.1075 into a position where there is now a corrective outlook once more. Thursday’s closing breach of $1.1060 effectively confirmed a 110 pip top pattern in a move that now implies further slide towards $1.0960. This comes with the market trading below all the moving averages whilst momentum indicators have turned corrective. The RSI confirms the top at five week lows under 50, MACD lines are sliding following a bear cross and Stochastics negatively configured. Given how intraday gains have consistently been sold into over the past week, the market ticking slightly higher early today is likely to be seen as an opportunity for the sellers. The main initial resistance is now $1.1060/$1.1075 and the configuration on momentum suggests that pressure on the next support at $1.0990 is likely in due course. A decisive breach of $1.0990 would suggest the October low at $1.0875 should not be ruled out.

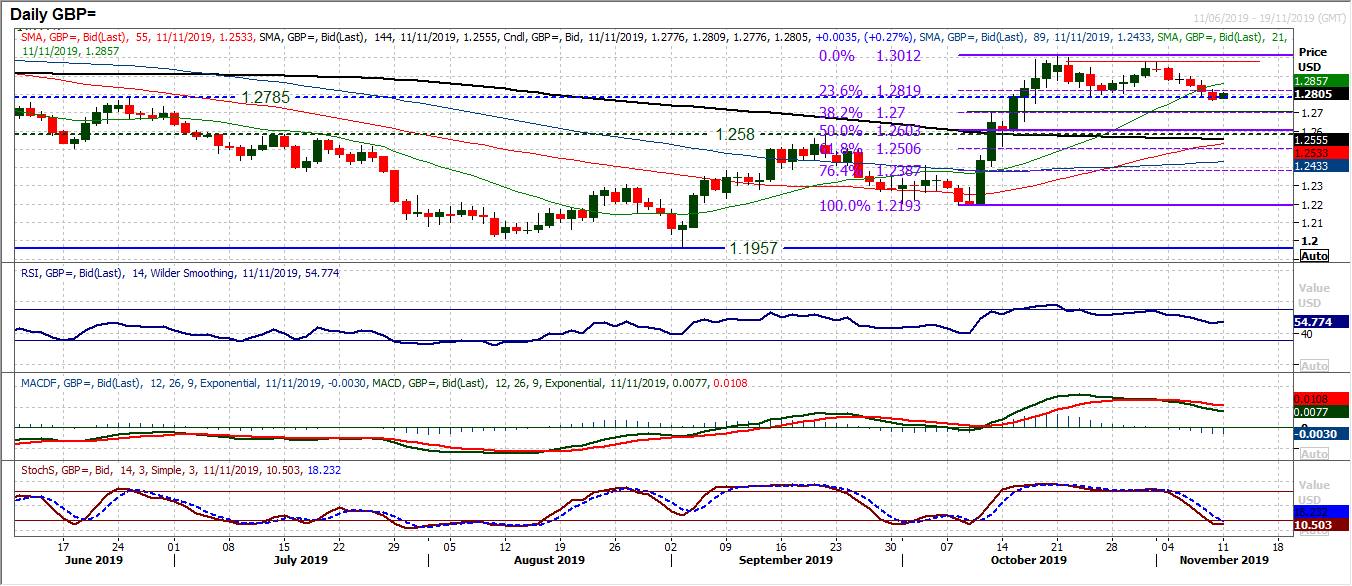

Cable has slide back in the past week in a move to test the $1.2785 medium term pivot level. We have recently been discussing that there is a far more settled outlook that has taken over in recent weeks, as the UK political risk for a no deal Brexit has reduced. We see that the election uncertainty will induce a negative drift on Cable in the coming weeks and the last few sessions have played into this. The market has left a lower high at $1.2975 (under the $1.3010 key October high) before forming a run of negative closes to test $1.2785. There is a far more stable nature to the slide on Cable (compared to EUR/USD) and this is allowing a simple unwind on momentum rather than anything more decisively bearish. The RSI has slipped back towards 50 whilst MACD lines are drifting lower. There has been an opening rebound today and it will be interesting to see how the market responds. The market has sold into intraday rebounds on each of the past five sessions and another today for a close back under $1,2785 would open for a deeper correction back towards the next band of breakout support $1.2580. The hourly chart shows initial resistance $1.2835 needs to be breached to re-engage the bulls within what is still essentially a three week trading range. Further resistance at $1.2875.

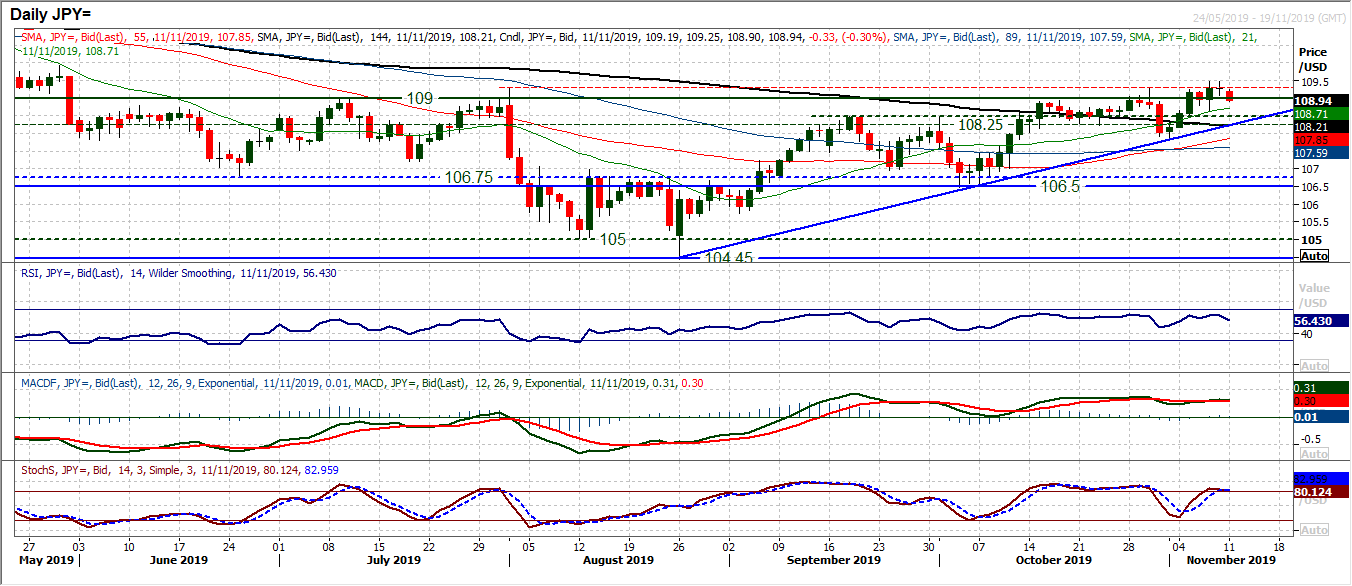

The dollar has spent the past week improving amidst slippage on the yen, in a move that is gradually breaking clear of resistance on Dollar/Yen. However, the shackles are still on, so can the decisive breakout be seen? It is a move that still needs to be viewed with cautious optimism for now. Whilst 109.00 has been cleared on a few occasions now, the market is yet to pull clear of 109.30 with any conviction. Momentum indicators have been building an improved outlook but once more, the RSI is failing around 60 whilst MACD lines are only tentatively higher. There is a sense that the intraday corrective moves are still a chance to buy, so the reaction to this morning’s slip back will be a gauge of the appetite in the market. Thursday’s higher low at 108.65 is subsequently a key marker for the bulls now to build from. Hold 108.65 and the bulls remain in control. The hourly chart does though, once more, reflect a slightly underwhelming positive bias on momentum. The last couple of highs at 109.50 are resistance that are preventing 109.90 and on towards 110.65.

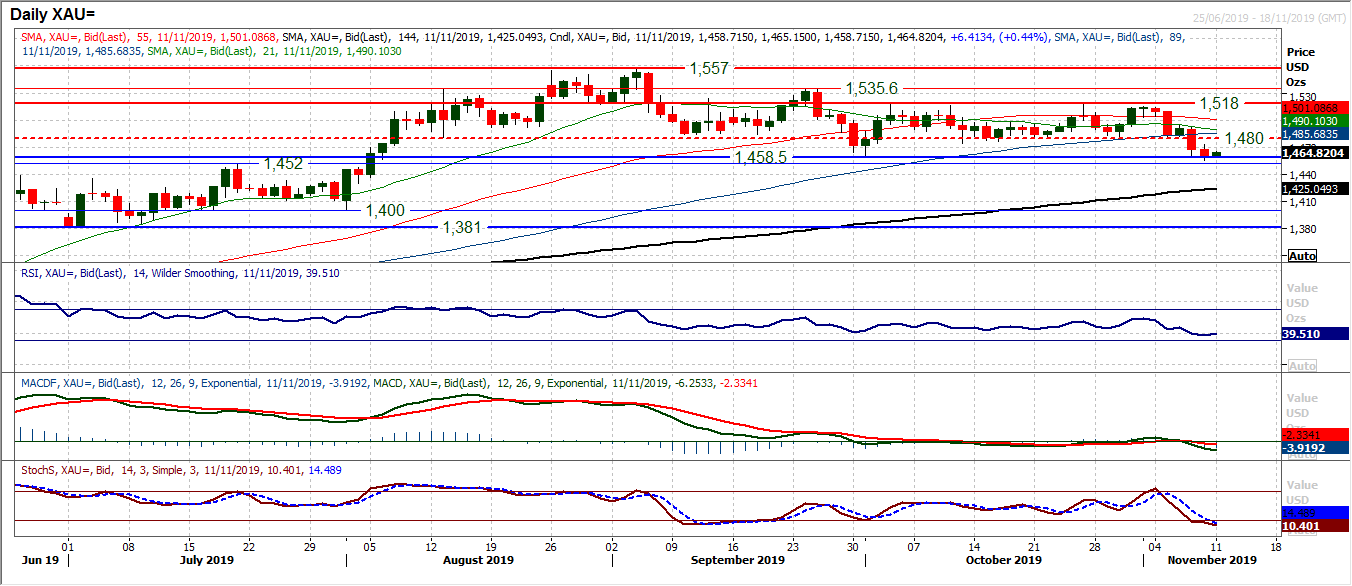

Gold

There has been an uncertain and ranging outlook to gold for the past few months. However, after a run of negative candles over the past week, the market is finally on the brink of a crucial outlook changing move. Thursday’s decisive bear candle below $1480 was a key move that really showed the selling pressure mounting. It came with the RSI falling decisively below 40 for the first time since April and suggested a real shift in sentiment. MACD lines turning lower and Stochastics under 20 also showed a growing sense of the market turning against gold. There has been an intraday breach of the October low at $1458 but interestingly, Friday’s close was bang on the support, whilst the market has ticked slightly higher today. This leaves the market still at a crucial tipping point. An intraday failure for the bulls today with a close under $1458 would see a confirmation of a new negative outlook on gold. The bulls have their work cut out now, with resistance $1474/$1480 also now a significant barrier of overhead supply. The early rebound today could just be prolonging the bear move. Initial resistance $1468.

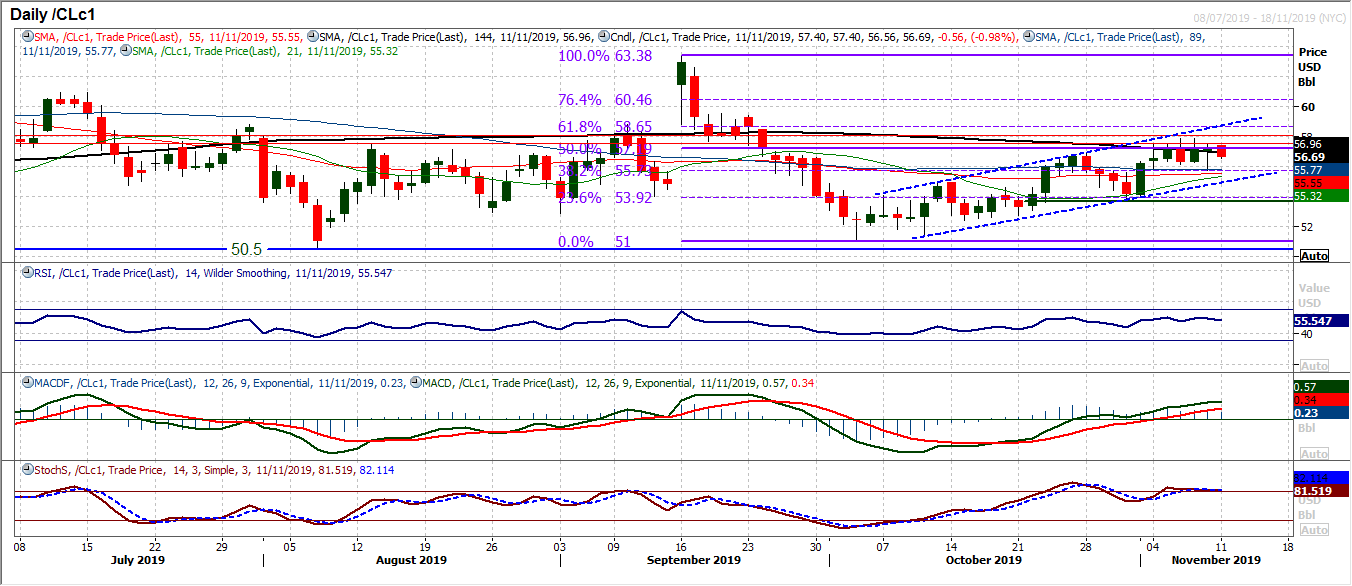

WTI Oil

The development of the uptrend channel in recent weeks has continued to form an outlook of buying into weakness on oil. Whilst there is a continued lack of conviction that leads to oil intermittently slipping back, the bulls still retain a degree of control. Last week the resistance around an old pivot band around $57.50/$58.00 prevented another leg higher towards the top of a five week uptrend channel (which today comes in at $58.70 and is a confluence with the 61.8% Fibonacci retracement (of $63.50/$51.00) at $58.65. We continue to view the bottom of the channel around $55.00 today as an area the bulls would look for an opportunity again.

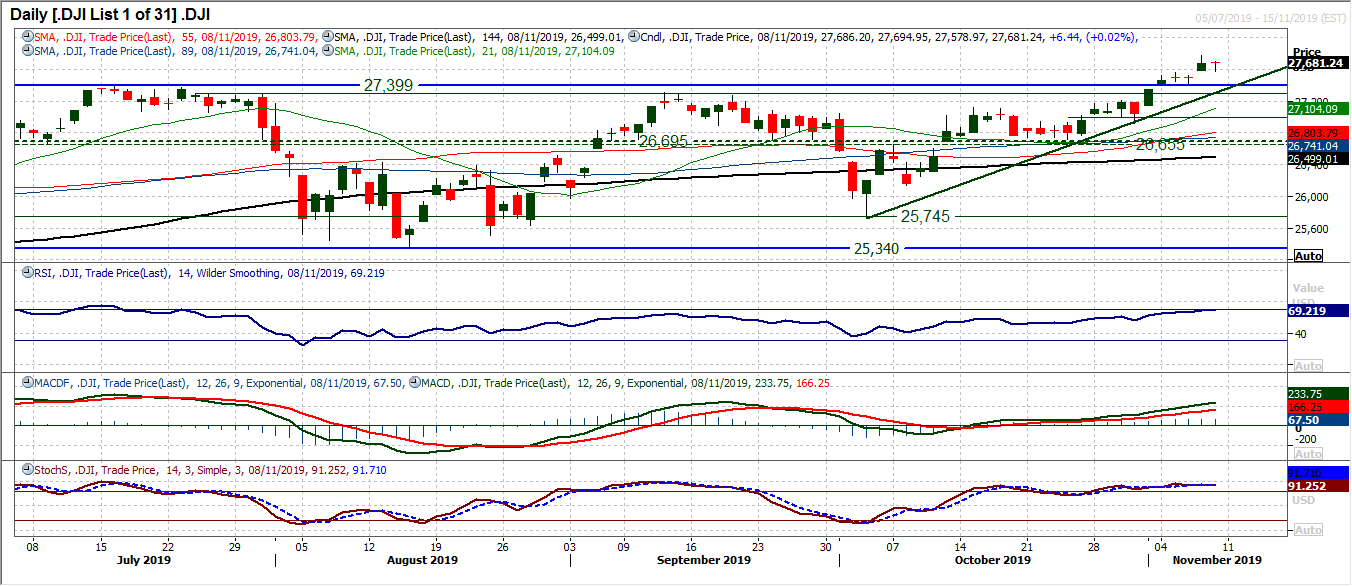

There is still a propensity for the bulls to use weakness as a chance to buy the Dow. Another gap higher on Thursday just stalled slightly into Friday, but intraday weakness was bought into to close the day near to session highs. Traditionally, a doji candle suggests an uncertainty in the prevailing trend, however, two of the past three breakout gaps remain unfilled and the latest gap at 27,527 is currently adding another unfilled gap. The bulls are in control of the market and holding on to the 27,305/27,399 support band is a key band of underlying demand. The new all-time high (from Thursday (at 27,775) is resistance initially. The strength of momentum in this run higher is across the indicators, with RSI towards 70 and MACD lines rising solidly. The hourly chart shows a solid positive configuration and this is a run that has not finished yet.

"""DISCLAIMER: This report does not constitute personal investment advice, nor does it take into account the individual financial circumstances or objectives of the clients who receive it. All information and research produced by Hantec Markets is intended to be general in nature; it does not constitute a recommendation or offer for the purchase or sale of any financial instrument, nor should it be construed as such.

All of the views or suggestions within this report are those solely and exclusively of the author, and accurately reflect his personal views about any and all of the subject instruments and are presented to the best of the author’s knowledge. Any person relying on this report to undertake trading does so entirely at his/her own risk and Hantec Markets does not accept any liability. """