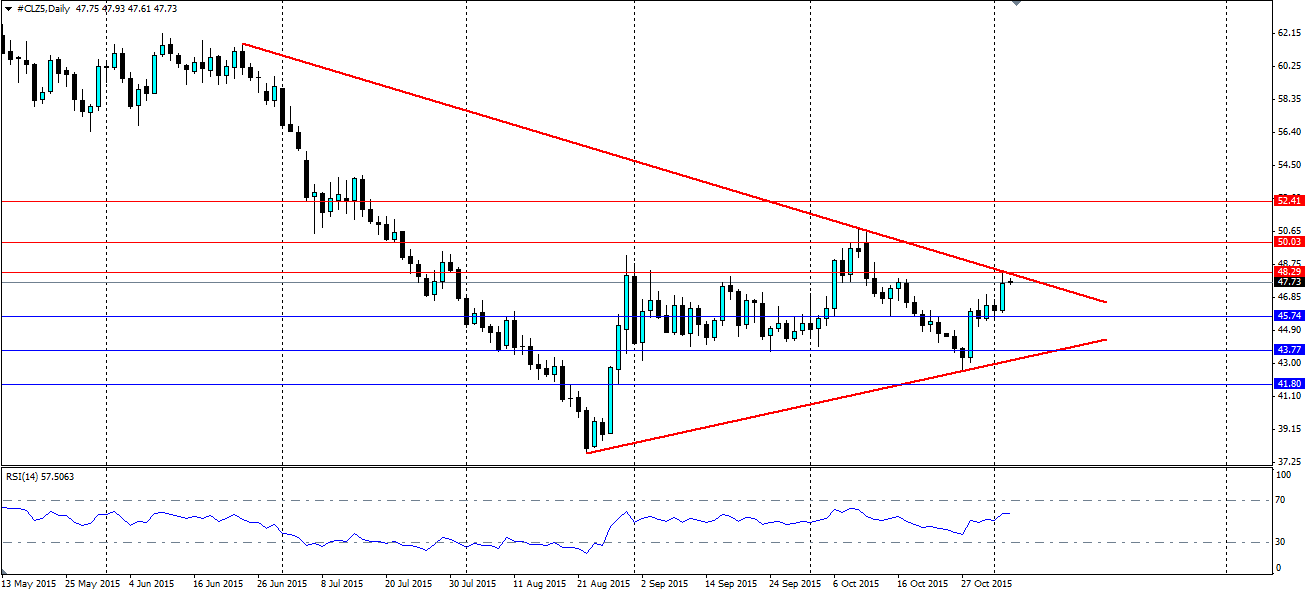

Oil is consolidating in a very large pennant shape that is getting close to the critical point. Resistance has been found along the top of the shape and a short-term bearish leg is likely. In the longer term, a large breakout is inevitable.

The last 24 hours have seen a solid rally in crude prices which has met resistance at the top of the large consolidating pennant shape. There have been some supply concerns crossing the wires that have given oil bulls hope that things might improve for the beleaguered commodity. The unfortunate reality is that the underlying fundamentals haven’t changed.

The news in question emanates from Brazil and Libya. In Brazil, oil workers went on strike on Sunday over the sale of state assets as well as a pay dispute. The strike has cut around half a million barrels of output in the first 24 hours. It has also slowed Petrobras' (N:PBR) output by 25%, which will have a considerable effect on exports for the nation. Brazil is the world’s ninth largest oil producer, so this could be a story to keep an eye on.

There are also supply troubles in Libya where the export terminal at the port of Zueitina has been closed under force majeure. Escalating conflict between the country's two rival powers has put the port at risk. Force majeure is a legal clause protecting parties from liability if they cannot fulfill their end of a contract for reasons out of their control. The closure will cut 100,000 bpd from Libya’s exports.

These events have been priced in, which opens the door for a short-term rejection off the bearish trend line. The fundamental situation has not changed, especially in the US where production remains robust. This can be seen in the API crude inventory figures which jumped another 2.8m barrels last week. Keep an eye on the official figures due later today for further confirmation of the oversupply.

In the longer term, there is likely to be action in the form of a breakout of the consolidation pattern. It could go either way and will likely depend on the fundamental situation. If things don’t change, expect a breakout lower. In the meantime, look for support at 45.74, 43.77 and 41.80 with resistance at 48.29, 50.03 and 52.41.