Kathy Lien, Managing Director Of FX Strategy For BK Asset Management

Daily FX Market Roundup October 23, 2019

European politics have dominated the headlines this week but the most important event risk on the calendar will be Thursday’s Eurozone PMIs and the October European Central Bank monetary policy announcement. Having just rolled out a series of measures to stimulate the economy in September, no further action is expected from the central bank. So unlike September 12 when EUR/USD had a 160-pip daily range after ECB, the moves in the currency pair this month will be more measured. In fact, we would not be surprised if the market shrugged off the event.

The most important part of the ECB meeting will be Mario Draghi’s press conference but considering that this will be his last ECB meeting after an eight-year term, the chance of revealing announcements is slim. The meeting will be a largely ceremonial one but he’ll probably call on governments to step in with fiscal stimulus.

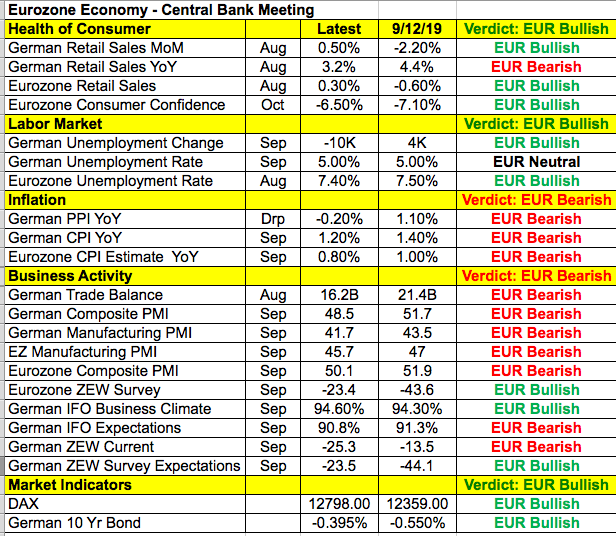

When the numbers are released there’s a very good chance that Germany fell into recession in the third quarter. However taking a look at the table below, there have been improvements in the economy since the last meeting. Retail sales are up across the region, consumers feel less pessimistic as the unemployment rate declined. Business and investor confidence are showing signs of stabilization. However inflation is low, while manufacturing- and service-sector activity weakened in September. Before the ECB meeting, we’ll know if those conditions worsened or improved in October. Based on these reports and the prospect of a Brexit delay, the ECB has fewer concerns this month.

According to euro-area officials, the ECB doesn’t expect any more easing in the coming months despite the prospect of lower economic projections in December. Christine Lagarde’s first central-bank meeting in December will be far more revealing, particularly since it will be accompanied by changes in their forecast.

So in all likelihood, the ECB meeting will be a nonevent for the currency. For the time being, the euro will trade on Brexit developments but as the Federal Reserve’s monetary policy announcement nears, U.S. dollar flows will drive the currency’s moves. Technically, EUR/USD has fallen below the 100-day SMA but with the Fed poised to cut rates, we see the pair breaking above 1.1150.