- Reports Monday, April 16, after the close

- Revenue Expectation: $3.69B

- EPS: $0.64

There is no room for error for the video-streaming giant Netflix (NASDAQ:NFLX) when it reports its Q1 2018 earnings on Monday, April 16.

The stock has added more than $50 billion in market value in 2018 and traded above analysts' average price forecast for most of the past three months, on expectations that the company will continue to attract more subscribers, even as it faces no real competitor who could challenge its dominance in the video-on-demand market.

We think Netflix is well positioned to continue with its excellent growth trajectory. With its aggressive spending program to create new content and to market that content innovatively, Netflix is in a great position to add subscribers both in the U.S. and globally.

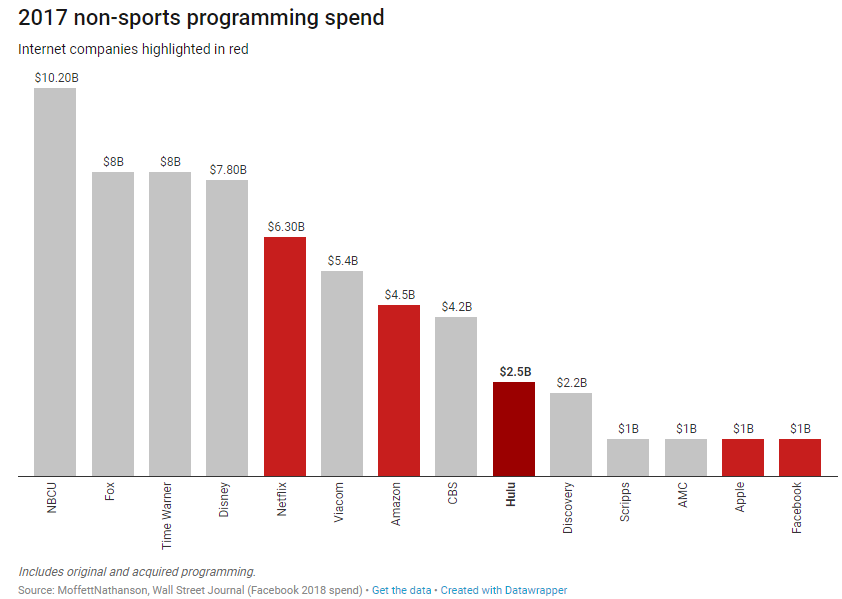

Netflix spent $6.3 billion on original and acquired content in 2017 according to research firm MoffettNathanson. Recode reports that's a bigger spend than any other steaming provider. It puts Netflix just a bit behind such traditional media companies as Time Warner (NYSE:TWX), Fox (NASDAQ:FOX) and Disney (NYSE:DIS) with regard to non-sports programming expenditures.

The company’s aggressive spending on original content and marketing means it won’t be able to generate free cash flow for the next few years. But investors have a high tolerance for Netflix’s cash burn as long as its Chief Executive Officer, Reed Hastings, is successful at adding more connections.

Media companies—on both the content production and distribution sides—are realizing that they have no choice but to embrace Netflix. Comcast (NASDAQ:CMCSA), for example, announced last week it will add Netflix to its subscription packages across the country, giving its customers a choice to pay for the Netflix service directly through its bundle.

This is a big win for Netflix, which could use the Comcast platform to boost its subscriber growth in the U.S. market. This is an especially timely move: domestic subscriptions have shown some signs of peaking, making some investors nervous.

But the biggest growth driver for Netflix is the strength of its international business. We think continued momentum in Netflix international markets is critical to its rich valuation. It's also the major catalyst for the stock price to move higher from here.

Wall Street is expecting 1.45 million net subscriber additions in the U.S. and 5 million globally. That compares with the company’s forecasts of 1.45 million and 4.9 million.

Look for a number close to 6 million for the global net additions. That number would be good enough to spark another rally, taking the Netflix share price closer to $350, a 12% jump from its Friday close of $311.65.