This article was written exclusively for Investing.com

- A wild ride since March

- Interest rate differentials took some of the bullish wind out of the dollar’s sails

- Election time in the US could cause volatility over the coming months

The US dollar is the world’s reserve currency, which means that central banks around the globe hold it as part of their reserves. Reserve currencies have three characteristics. They reflect political stability since fiat currencies derive value from the full faith and credit of the government that issues the legal tender. Economic stability is another significant factor. Reserve currencies also need to be freely convertible to other foreign currencies.

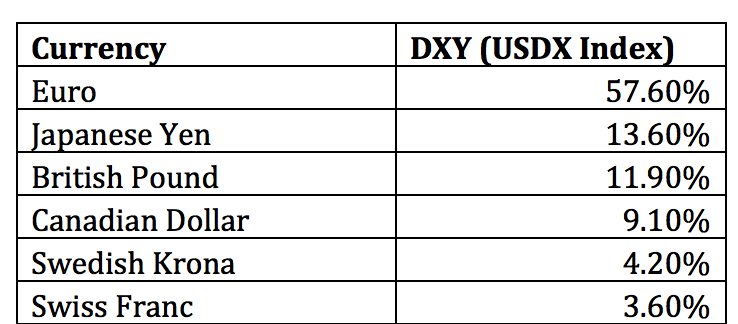

The Dollar Index measures the value of the US greenback against other reserve currencies. The index trades on the Intercontinental Exchange (ICE) in the futures market.

Source: ICE

As the chart shows, the Dollar Index has a 57.6% exposure to the euro, the single currency used in 19 out of the 27 states in the European Union, the world's second-leading reserve currency.

When all hell broke loose in markets in March, a result of the global spread of coronavirus, the Dollar Index dropped to a low of 94.61, then proceeded to rise to a high of 103.96 in mid-March. The peak was the highest level since 2002.

This flight-to-quality buying in the foreign exchange market took the greenback to an eighteen-year high. But, at the end of last week, the Dollar Index was sitting below the 98 level, closer to the recent low than the March high.

The Dollar Index will need to remain above the 94.61 level to keep intact the bullish trend that has been in place since February 2018.

Wild ride since March

Currency markets tend to exhibit low levels of price variance, but the action in the foreign exchange arena in March caused a spike in volatility.

Source: CQG

The weekly chart of the Dollar Index highlights that historical volatility peaked at over 19% in March, the highest level for the index in many years. The decline has taken price momentum and relative strength indicators below neutral readings.

Open interest, the total number of open long and short positions in the Dollar Index futures market, was below the 19,000-contract level at the end of last week. The price action in the index pushed the open interest to its lowest level in over a decade as market participants exited risk positions.

The medium-term trend in the Dollar Index remains bullish, but the index needs to stay above the 94.61 level, the low from March, to keep the trend alive.

Interest rate differentials took some bullish wind out of dollar’s sails

Perhaps the most supportive factor for the strength in the Dollar Index since 2018 had been the wide gap between US and European rates. The short-term Fed Funds rate in the US rose to over 2%, while the deposit rate in Europe remained in negative territory. While the ECB pushed the short-term rate ten basis points lower over the past months to negative fifty basis points, the US Fed slashed its rate to zero.

The compelling case for selling euros and buying dollars to gain the yield differential evaporated as the global pandemic caused central banks to return to drastic monetary policy moves. The decline in the yield differentials is one of the reasons why the Dollar Index fell, as the euro accounts for almost 58% of the index.

Election time in the US could cause volatility over the coming months

Uncertainty over the upcoming Presidential election in the US is another factor pressuring the value of the dollar. The November contest between President Trump and former Vice President Joe Biden will be a referendum on the incumbent president’s performance.

At the same time, it will determine the future of tax, regulatory, energy, and many other policy issues for the coming years.

The current administration has supported a weaker dollar since it makes US exports more competitive in global markets, boosting the profits of US multinational companies. Moreover, the falling dollar can be a substantial tool when it comes to trade negotiations. Previous administrations have favored a strong-dollar policy.

We are likely to see continued volatility in the Dollar Index over the coming weeks and months. Any move below 94.61 and 93.395, the September 2018 low would be a technical breakdown in the index. As the reserve currency of the world, the path of least resistance of the US dollar could impact markets across all asset classes throughout 2020.

Yield differentials and uncertainty over the November election could create lots of price variance in the greenback and runs the risk of ending the bullish trend that has been in place since the index hit a low of 88.15 in early 2018.