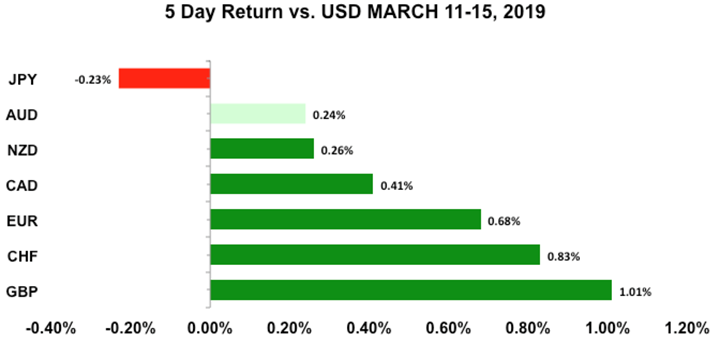

The US dollar has been in an uptrend for most of the quarter but in the past week, the greenback lost momentum and its decline has some investors wondering if the dollar will continue to fall ahead of this week’s Federal Reserve monetary policy announcement.

We’ll discuss this and more when we focus on the greenback but the combination of softer data and stronger risk appetite made it difficult for the dollar to rally. US data has disappointed for some time but the greenback hit multi-month highs earlier this month because the uncertainty and weakness abroad was greater than the problems at home. Part of those concerns faded last week after the UK voted to rule out the no deal Brexit that would have plunged Britain, Europe and a large swath of the financial markets into a chaotic void. Equities rallied across the globe and the improvement in risk appetite helped lift high-beta currencies like EUR, AUD and NZD. Looking ahead, sterling will remain in focus with a third Brexit vote on Tuesday and a Bank of England monetary policy announcement Thursday. The Federal Reserve meets on Wednesday and we don’t expect any helpful comments from Fed Chairman Powell.

US Dollar

Data Review

- Retail Sales 0.2% vs 0% Expected

- Retail Sales ex Autos and Gas 1.2% vs 0.6% Expected

- CPI MoM 0.2% vs 0.2% Expected

- CPI MoM Ex Food and Energy 0.1% vs 0.2% Expected

- CPI YoY 1.5% vs 1.6% Expected

- PPI MoM 0.1% vs 0.2% Expected

- PPI YoY 1.9% vs 2% Expected

- Durable Goods Orders 0.4% vs -0.4% Expected

- Jobless Claims 229K vs 225K Expected

- New Home Sales 607K vs 622K Expected

- Empire State Manufacturing 3.7 vs 10 Expected

- Industrial Production 0.1% vs 0.4% Expected

- University of Michigan Sentiment Index 97.8 vs 95.6 Expected

Data Preview

- FOMC Rate Decision – Fed will most likely maintain a patient stance, limiting gains in USD

- Philadelphia Fed Index – Potential downside surprise given a drop in Empire state next

- Existing Home Sales – Potential downside surprise given a drop in existing home sales

Key Levels

- Support 111.00

- Resistance 112.00

Fed Meeting – An Excuse to Sell Dollars?

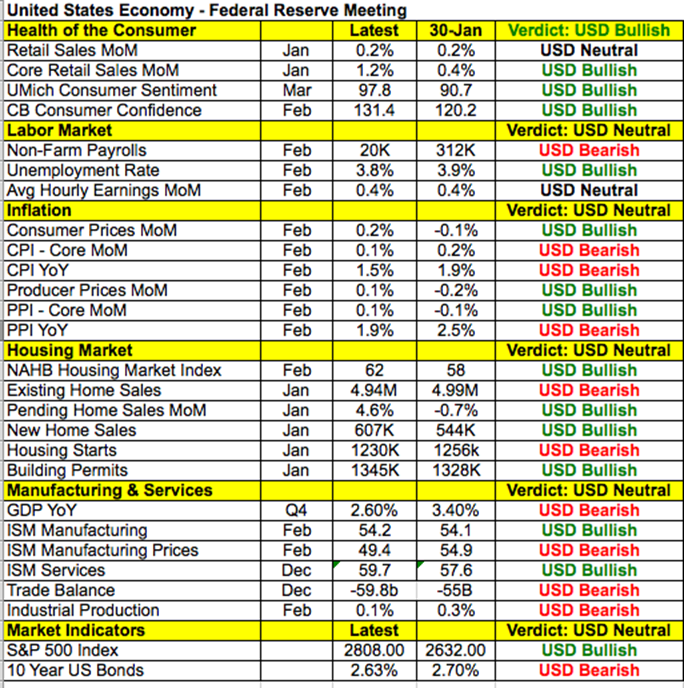

This week’s Federal Reserve monetary policy announcement could give investors an excuse to sell US dollars. No changes are expected from the Fed but press conferences follow every meeting this year and Chairman Powell’s comments could send the greenback lower. Even though there have been more improvements than deterioration in the US economy since the last central bank meeting, the Fed is in no rush to raise interest rates. Last week, we learned that retail sales increased by only 0.2% in January as payroll growth slowed to 20K in February. The housing market has peaked with rising interest rates slowing new and existing home sales growth. While manufacturing and service sector activity recovered, the US trade deficit hit an all-time high. Most importantly, inflation is low with consumer price growth easing to 1.5% from 1.9% in February. So even if the central bank finds the uptick in confidence, wages, economic activity encouraging, low inflation gives them the flexibility to hold off tightening until there are signs of consistent strength in the economy. When the Fed last met, the dollar plunged after they removed the reference to further gradual rate increases from their monetary policy statement. We don’t expect the dollar to crash at this upcoming meeting but we can expect Powell to his “patient” approach on rates, which could be enough to encourage profit taking on long dollar positions.

One of the primary reasons why the dollar outperformed in the first quarter is relative weakness abroad but as some big uncertainties subside, money could flow back into riskier currencies and riskier assets. Britain still doesn’t have a Brexit deal but at least we know that they won’t be spinning out without an agreement. Slower growth in China has been a big problem for the rest of the world but tax cuts could provide a big boost to the economy. The prospect of improvements could make other investments more attractive, easing demand for US dollars even as the US economy outperforms. In the long run, however, demand for the greenback should remain strong as the Fed remains the only major central bank to raise interest rates this year. USD/JPY is in an uptrend but if it falls back below 111, we should see a deeper slide towards 110. The Bank of Japan left interest rates unchanged last week but lowered its export and output assessment in response to terrible trade numbers.

AUD, NZD, CAD

Data Review

Australia

- NAB Business Confidence 2 vs 4 Previous

- Home Loans -1.2% vs 2% Expected

- Westpac Consumer Confidence 98.8 vs 103.8 Previous

- Consumer Inflation Expectations 4.1% vs 3.7% Previous

New Zealand

- Card Spending 0.9% vs 0.3% Expected

- Food Prices 0.4% vs 1% Previous

- Business PMI index 53.7 vs 53 Previous

Canada

- New Housing Price Index -0.1% vs 0% Expected

- Manufacturing Sales 1% vs 0.4% Expected

- Existing Home Sales -9.1% vs -4% Expected

Data Preview

Australia

- RBA Minutes – Central bank is likely to maintain a cautious tone

- Employment Change – Potential upside surprise given the sharp improvements in the employment component of manufacturing and services PMI

New Zealand

- PMI Services – Potential upside surprise given rise in PMI manufacturing

- Q4 GDP – Potential for upside surprise given an improvement in retail sales and trade activity

Canada

- CPI and Retail Sales – Potential for upside surprise given the stronger employment and price component of IVEY PMI

Key Levels

- Support AUD .7000 NZD .6800 CAD 1.3250

- Resistance AUD .7100 NZD .6900 CAD 1.3400

Tax Cuts Coming For China

The improvement in risk appetite helped all 3 commodity currencies come off their lows last week but their recoveries were modest compared to the moves in European currencies. The problem is that investors have no idea if and when a trade deal between the US and China will be reached. Every time President Trump says they are close, the agreement comes apart at the last minute. It's true this time, as well as the meeting and “signing summit” between Trump-Xi, gets pushed back to at least April. Talks aren’t going as well as US President has suggested and in his own words, he’s in “no rush” to complete a deal now that equities are recovering. So any support for Asian assets will have to come from China’s domestic policy measures. Thankfully, China is cutting taxes in a package worth more than 2 trillion yuan starting April 1st. The value-added tax for various sectors will be lowered in an effort to bring relief to businesses and consumers. Will it help the economy? Absolutely. Will it be enough to turn around growth? Probably not. Labor-market numbers are scheduled for release from Australia this week and while business confidence declined, we are looking for stronger job growth because according to the PMIs, companies in the manufacturing and services sectors added jobs at a faster pace last month. Compared to Australia, New Zealand is performing better with service-sector activity accelerating and card spending rising. Fourth-quarter GDP numbers are due for release this week and we are looking for an upside surprise as the trade balance and retail sales improve at the end of the year.

Meanwhile, USD/CAD may have put in a near term bottom. Rising oil prices helped to drive the Canadian dollar higher over the past week but the rally lost steam as the pair found support above 1.33. Technically this is an important support level but fundamentally, investors are looking for evidence to support the Bank of Canada’s dovishness. While stronger employment and higher oil prices should drive this week’s CPI and retail sales reports higher, the risk of a downside surprise has limited the slide in USD/CAD.

The New Zealand dollar, on the other hand, has fundamental support for its decline. Despite the recovery in dairy prices, the country’s trade surplus turned into a deficit in the month of January. The balance was three times worse than expected and accompanied by a significant downward revision to the January figures. Although a large part of the deterioration was caused by higher crude prices blowing out the import balance, business and consumer suffered as a result. These numbers reinforce Governor Orr’s warning earlier last month that continued data deterioration could lead to a rate cut. NZD/USD erased all of its beginning of the week gains and is at risk of testing the February 22nd, .6758 low. With no New Zealand data on this week’s calendar, NZD should move in lockstep with AUD and take its cue from the market’s appetite for US dollars. Technically, ending the week at its lows is not good for the currency so while the 68 cent support still holds, for now, a move to .6750 is likely.

The Bank of Canada also has a lot to consider. The labor market is strong, but the rest of the economy is weak. When the central bank last met, it lowered its GDP and inflation forecasts. These changes were validated by the latest reports, which showed quarterly GDP growth slowing to 0.4% from 2%. Annualized CPI growth also dropped to its weakest level in more than a year. At the same time, oil prices are recovering and the Federal Reserve appears to be slowing its pace of tightening. We don’t expect the Bank of Canada to change its policy stance – which is no rate hikes at this time but eventually, it will need to move higher. What could be more important than the BoC will be the upcoming IVEY PMI and employment reports – given the strength of the last release, a pullback is likely. Technically, USD/CAD traded sharply higher on Friday and there’s a good possibility the pair will see 1.34 this week.

British Pound

Data Review

- Visible Trade Balance -13B vs -12B Expected

- Industrial Production 0.6% vs 0.2% Expected

- GDP 0.5% vs 0.2% Expected

Data Preview

- Bank of England Rate Decision – Central bank to emphasise Brexit risks. No reasons for them to talk after the cautious outlook

- Jobless Claims – Potential downside surprise. Services report the biggest decline in the employment index since 2011. Manufacturing sector reports the rate of job losses at 6-year high

- CPI – Potential upside surprise given the sharp rise in BRC shop prices and oil prices rebound

- Retail Sales – Potential downside surprise given drop in BRC retail sales index

Key Levels

- Support 1.3100

- Resistance 1.3350

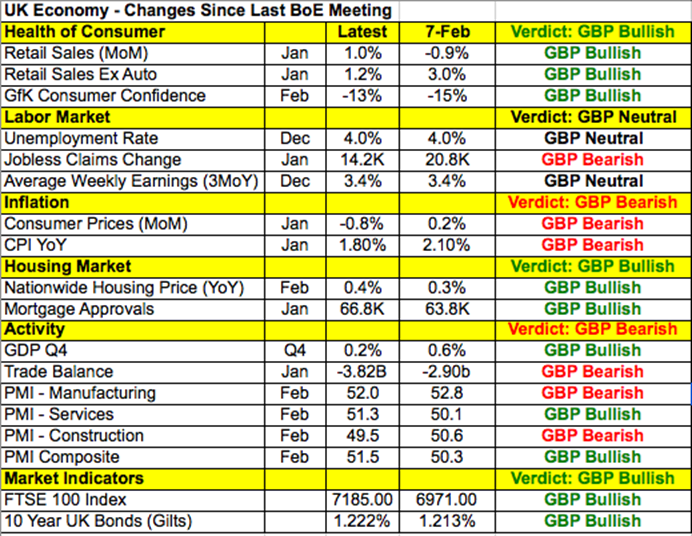

Third Time Lucky For PM May?

UK Prime Minister Theresa May refuses to give up on her Withdrawal Agreement. After being rejected by Parliament twice, she is widely expected to put the agreement to a third vote on Tuesday. As the options dwindle, the chance of Parliament supporting this deal increases but the margin of defeat means that very few people like the deal. The only reason why sterling is trading closer to 1.35 than 1.30 is because investors are relieved that no-deal is off the table. Of course, May who refuses to accept defeat said technically no deal is still the default until there is an agreement and she’s right. There are still 3 options – the current Withdrawal Agreement, No Deal or a Second Referendum. The government already asked to delay Brexit until June 30th but that’s predicated on Parliament accepting the current Withdrawal Bill next week. If they reject the deal again, the UK will have to request for a longer extension from EU. In the unlikely scenario that she wins, investors will send GBP sharply higher as the UK is finally freed from Brexit uncertainty. If she loses however, it may be up to the EU to decide how long the extension will be and the longer the delay, the better it is for the currency. May could still bring her a deal to a fourth vote before the March 29 deadline but its hard to see how she could rally the support she needs if she’s beaten down 3 times already. Considering that we don’t expect any surprises from Tuesday’s meaningful vote, the impact on sterling should be limited but the ongoing focus on Brexit won’t help the currency.

The Bank of England has no reason to be optimistic about the outlook for the economy. While it is operating under the assumption that a deal will be reached, a delay to Brexit prolongs uncertainty which is rarely positive for an economy. When the BoE met last month, it said the UK is set for its worst year since the financial crisis. BoE slashed its 2019 GDP and inflation forecast and expressed concerns about weaker growth and Brexit. Consumer spending picked up at the start of the year but not enough to change the central bank’s sentiment. We expect continued caution from a central bank that has no plans to raise interest rates this year. Aside from the BoE rate decision, UK retail sales, employment and inflation numbers are scheduled for release so we can expect bigger moves in GBP compared to other currencies.

Euro

Data Review

- German Industrial Production -0.8% vs 0.5% Expected

- German Trade Balance 14.5B vs 15.2B Expected

- German Current Account Balance 18.3B vs 18B Expected

- German CPI Revised Down to 0.4% from 0.5%

- EZ Industrial Production 1.4% vs 1% Expected

- EZ CPI 1% vs 1% Expected

Data Preview

- German ZEW Survey – Potential downside surprise given weaker industrial production, factory orders plus ongoing Brexit uncertainty

- EZ PMIs – Potential downside surprise give weaker industrial production, factory orders

- EZ Trade Balance – Stronger German trade balance offset by weaker French balance

Key Levels

- Support 1.1200

- Resistance 1.1400

1.10 euro still in reach

After rising 4 out of the last 5 trading days, EUR/USD is finding resistance beneath 1.14. While the rejection of a no-deal Brexit helped lift the euro, the single currency continues to be constrained by the weak economy. Germany, in particular, is struggling with industrial production falling and the trade surplus narrowing. This does not bode well for this week’s German ZEW survey and Eurozone PMIs. A softer economic outlook is one of the main reasons why the European Central Bank decided to introduce a third round of targeted refinancing operations and their pledge to keep policy accommodative throughout 2019 is the biggest reason for the currency’s limited recovery. With German 10-year yields hovering below 0.1%, we continue to look for EUR/USD to hit 1.10. It shouldn’t happen next week because the Fed won’t give investors a good reason to buy dollars but before the end of the year, this target will be reached.