EUR/USD is holding gains from the previous session after ending Wednesday 0.2% higher. Improved sentiment following the signing of the US – China trade deal (finally!) helped lift the common currency versus the safe haven greenback. However the euro is struggling to push higher after the trade deal left many questions unanswered and lacked any timetable surrounding phase two talks.

EUR/USD traders will now look ahead to a packed calendar of events which could drive movement in the currency pair today.

ECB Minutes

The minutes from the December ECB meeting are due to be released at 12 GMT. This was Christine Lagarde’s first meeting at the helm, whereby the central bank kept policy unchanged after cutting the overnight rate by 10 basis points in November. Traders will scrutinize the minutes closely to gauge whether we can expect further easing in the coming months.

US Retail Sales

US retail sales are expected to show sales increased 0.3% month on month in December, up from 0.2% in the previous month. The US labour market and consumer confidence are solid which could help buoy retail sales. A strong reading could boost USD.

Christine Lagarde

ECB President is due to speak in Frankfurt. Traders will be listening closely for remarks over the health of the eurozone economy. Recent data from German, shows GDP slowed to 0.6% yoy, down from 1.5%. Whilst inflation remains lacklustre at 0.5%. So far, we have not heard too much from Christine Lagarde and how she intends to tackle slowing growth and muted inflation in the region. We do know that she is in favour of more fiscal stimulus support from governments in the bloc. A push in this direction could boost the euro.

Levels to watch

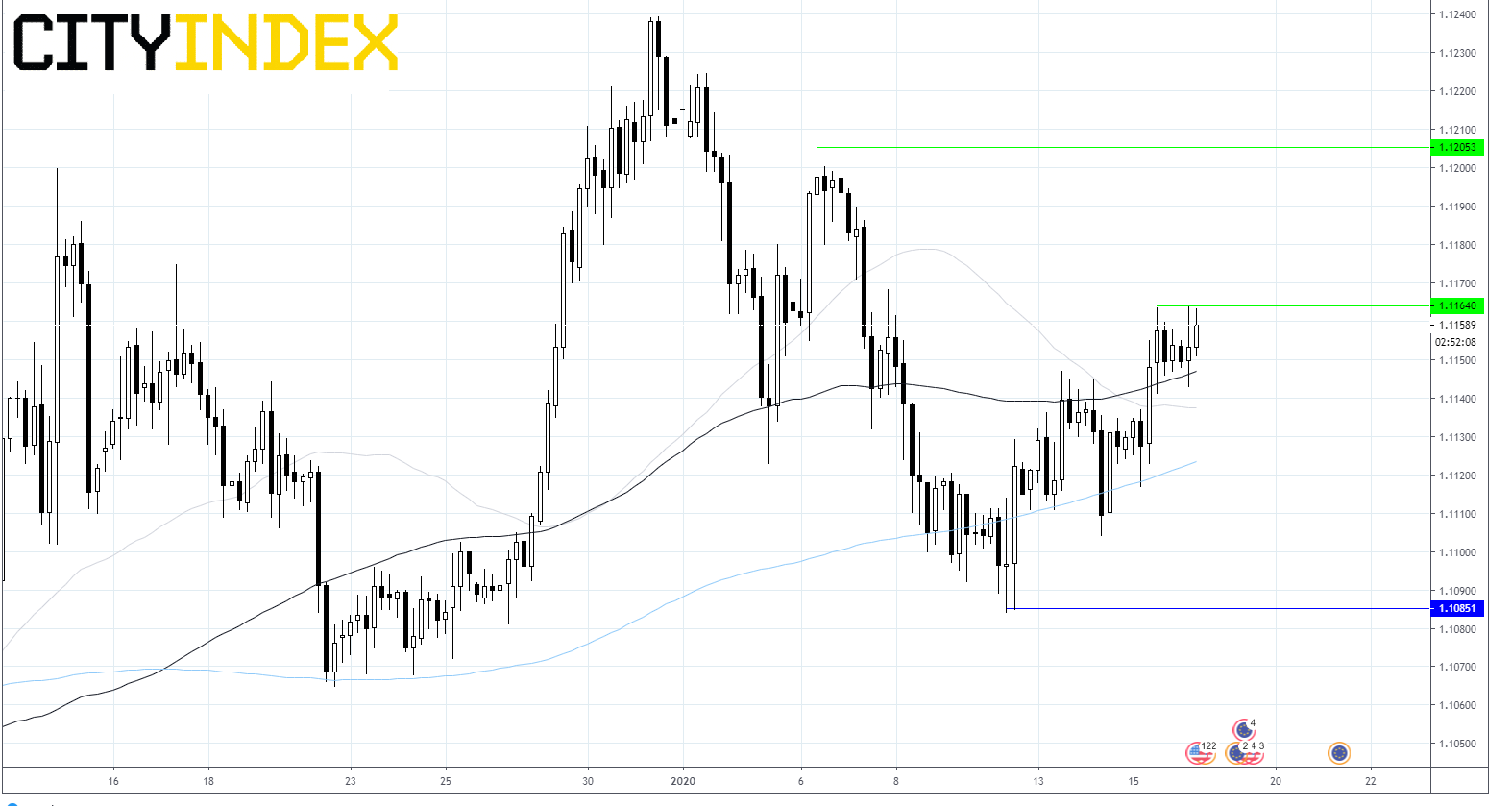

EUR/USD gained 0.2% in the previous session. The pair is trading above its 50, 100 and 200 sma on 4-hour chart indicating bullish momentum.

Immediate resistance can be seen at at $1.1164 yesterday’s high will need to be overcome, to advance to resistance at $1.12.

On the flip side, support can be seen around the 50 sma close to $1.1140, prior to Jan 10th low of $1.1085.

Disclaimer: The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient.

Any references to historical price movements or levels is informational based on our analysis and we do not represent or warrant that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, the author does not guarantee its accuracy or completeness, nor does the author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.