This post was written exclusively for Investing.com

The semiconductor sector has been hot in July, with the Philadelphia Semiconductor Index (SOX), rising by almost 10%. The strength in large part has been driven by better-than-expected earnings results and stronger-than-expected outlooks.

The strength within the group has been astounding, with some stocks rising by 15% or more, just in July. Leading the rally have been companies like Micron Technology (NASDAQ:MU), KLA-Tencor Corporation (NASDAQ:KLAC), Teradyne (NASDAQ:TER), and Applied Materials (NASDAQ:AMAT). It isn’t just better-than-expected results that are driving the group higher; hopes of a solution to the trade dispute between the U.S. and China are also helping.

Better Results

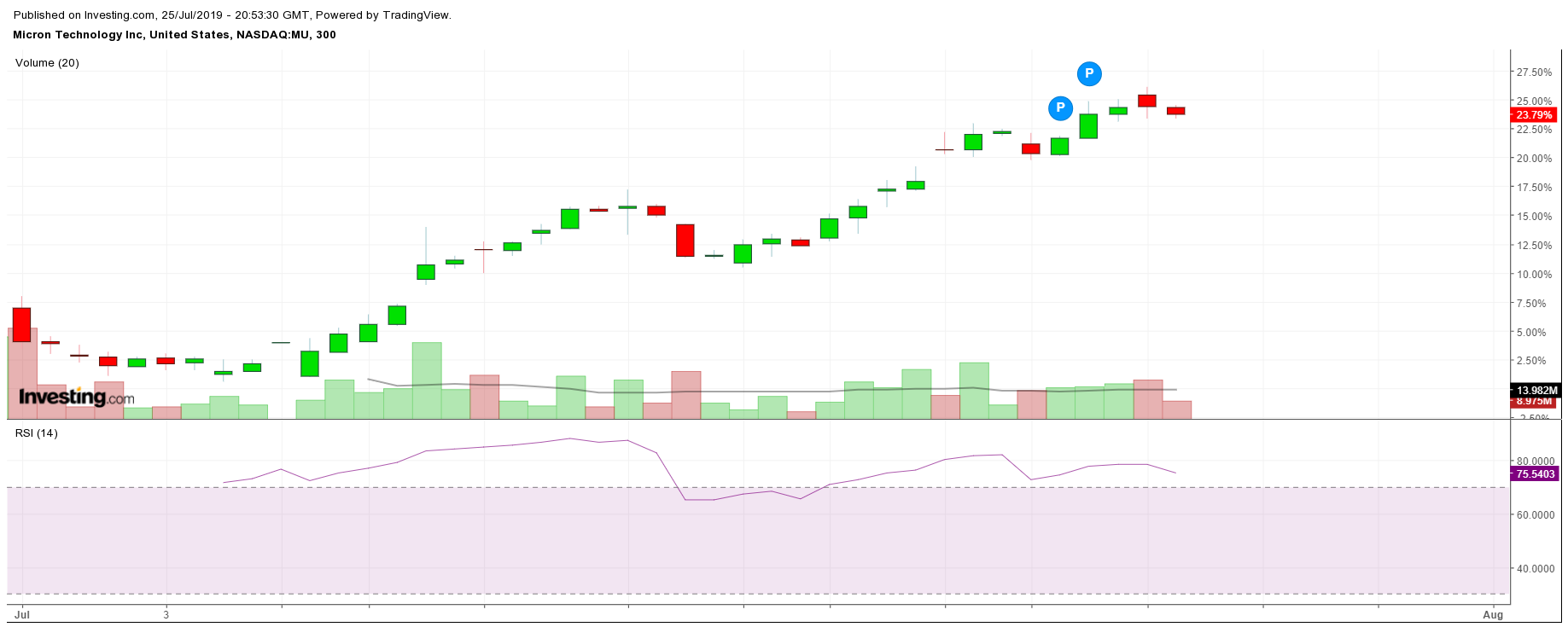

Micron was one of the first companies to deliver better-than-feared results. The company reported fiscal third quarter 2019 results on June 25, with earnings coming in a stunning 33% higher than expected. Meanwhile, revenue came in nearly 2% better. It has resulted in Micron’s stock rising by over 46% since June 25, and by over 23% in July alone.

Teradyne, a semiconductor equipment maker, has surged by nearly 17% in July. The company reported second-quarter results on July 23 that topped analysts’ forecasts on both the top and bottom line. Earnings were 7% higher than estimates, while revenue was more than 5% better.

Better Guidance

It isn’t just the earnings that are coming in ahead of forecasts; it’s the guidance too. Companies like Taiwan Semi (NYSE:TSM) gave a better than expected revenue outlook for their third quarter when they reported second-quarter results on July 18.

Texas Instruments (NASDAQ:TXN) is another company that supplied investors with better than expected guidance. The company sees third quarter earnings of $1.42 at the mid-point, which was better than analysts’ consensus estimates of $1.38 per share.

Intel (NASDAQ:INTC) was the latest to deliver strong results. On July 25, the company raised its full-year 2019 earnings guidance to $4.40 per share, higher than estimates of $4.22.

Trade Fears Ease

Additionally, the group has been getting favorable news on the trade front. Following the G20 summit, the U.S. and China have once again agreed to call a trade war truce, with a new round of trade negotiations starting up again. Also, there have been discussions about the U.S. easing up on the selling restrictions to the China-based telecom equipment maker Huawei.

A Reason For Caution

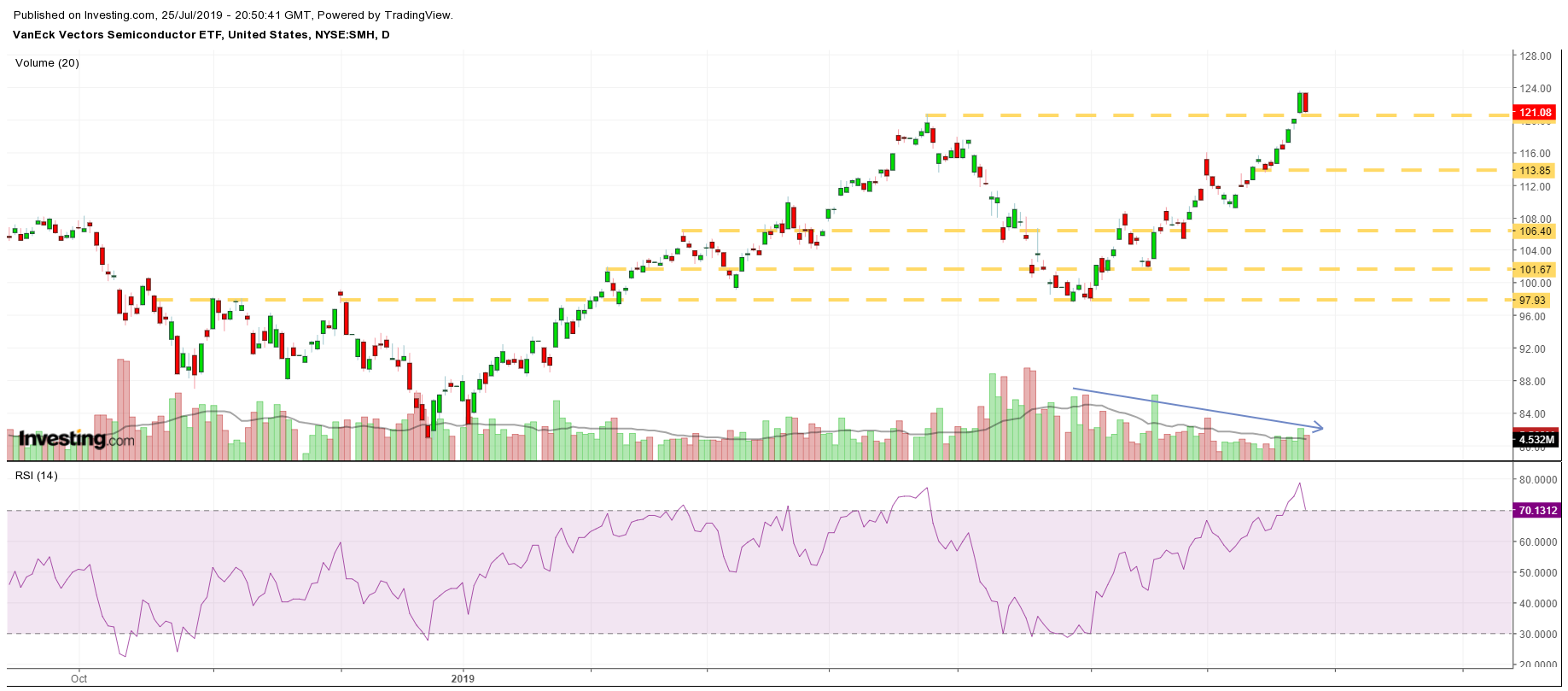

That said, the sector’s hot July has sent the VanEck Vectors Semiconductor ETF (NYSE:SMH) to an all-time high, and the group may now be showing some signs of taking a breather. The technical chart shows that the ETF is currently resting on technical support at $120.70. Should the ETF fall below that support level, it could fall to around $114, a drop of roughly 6%.

The relative strength index is also suggesting the ETF is showing signs of fatigue. The RSI is now at overbought levels with the index rising to as high as 79 on July 24. Typically, when the level climbs above 70, it is in overbought territory. Also, the ETF has been rising on falling levels of volume. It could suggest that the number of buyers is beginning to fade.

There is no doubt that the semiconductor sector has been among the hottest in the market for July. The strong performance has been driven by better than expected underlying fundamentals and signs of improvement in the business outlook.

If those two trends continue throughout the second-quarter earnings season and spill over to the rest of the year, the group may still have much further to go.